- A blend of strong US economy and AI tech appetite brings more tailwinds to Nvidia, TSMC and Meta stock prices in August. But that's not all.

The AI industry has proven its resilience and stayed on the growth path amid trade tariff turmoil. Furthermore, a strong US economy helps the case for continued growth by this industry. It is therefor not a surprise that all three of our August top stocks have links to AI.

Nvidia

This is the market bellwether in as far as Artificial Intelligence is concerned. Nvidia stock price has risen by 16% in the last month and is up by 33% year-to-date. These numbers have a strong performance backing, and impressive growth projections that will likely keep investors angling for a piece of the stock.

Nvidia (NASDAQ: NVDA) closed its fiscal FY 2025 on a high note, recording a 78% YoY revenue growth in Q4 to reach $39.3 billion. In addition, it doubled its full-year revenue to $130.5 billion, and the lowering of barriers to exports to China will likely push its earnings higher. Nvidia is expanding its footprint beyond just hardware, and is building AI software targeting personal AI supercomputers. This promises a long growth runway that will likely extend beyond big tech companies to homes, schools and offices.

Nvidia stock price prediction in August

Pivot: NVDA will likely pivot at $176. The upside will prevail as long as action stays above that level.

Resistance: Initial resistance likely at $185. Breaching that barrier could result in further gains to test $190.

Support: Primary support at $168. Secondary at $160.

Taiwan Semiconductor Manufacturing Company (TSMC)

TSMC stock price is tethered to Nvidia’s thanks to its position as the undisputed market leader in semiconductor production. With its chips production contracts rising steadily, the company has embarked on an aggressive expansion plan and aims to complete the construction of nine new production plants it 2025 to meet the surging demand.

Meanwhile, it showcased its production muscle through the ramp-up of its 2-nanometer chips production on Q2 2025. As far as earnings go, its Q2 revenue grew by $30.1 billion, translating to 60.7% YoY growth, and the resulting positive sentiment will likely continue providing medium-term support to TSMC stock price.

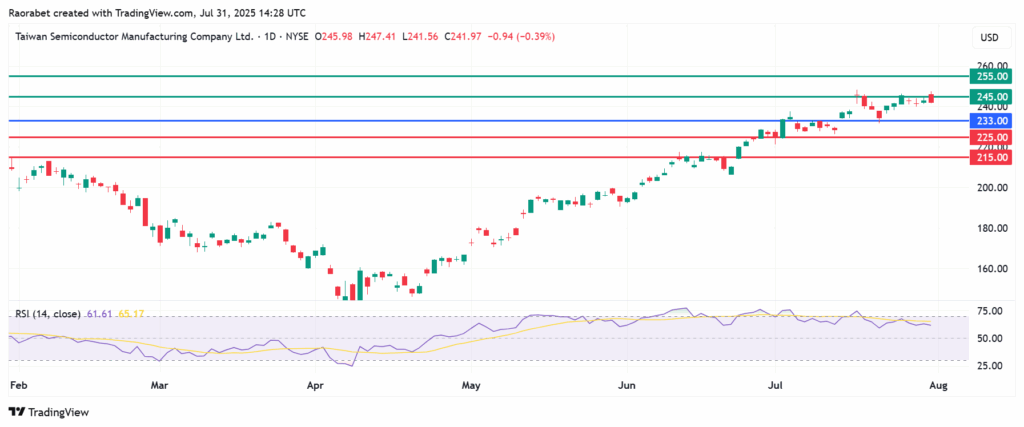

TSMC stock price prediction August

Pivot: The stock will likely pivot at $233 and action above that level will favour the upside.

Resistance: Primary Resistance will likely be at $245. Second barrier likely at $255.

Support: First support likely at $225. Breaking below that level could clear the path to test $215.

Meta

After a failed metaverse journey, Meta (NASDAQ: META) is steadily transforming from a social media giant to a force to reckon with in the AI race. It has spent tens of billions in AI infrastructure capex, and the good news is that it is paying off-unlike the metaverse. Meta stock price is responding to the company’s integration of AI in its Facebook, WhatsApp, Instagram and Threads platforms, with advertising revenue growing as a result of optimised user engagement and personalised content.

As per its quarterly earnings released on July 30, advertising ARPU grew by 9%, thanks to AI. In addition, its daily active user numbers grew by 6% during the reported quarter. Furthermore, it gave a strong revenue guidance for Q3. The company forecasts that it will earn between $47.5 billion-$50.5 billion during the current quarter, and that adds credence for a strong performance by Meta stock price in August.

Meta Stock Price Prediction

Pivot: Meta stock price will likely pivot at $760, and the upside will prevail above that level. Otherwise, the momentum could shift to the downside.

Resistance: First resistance likely at $790. Second one at $810.

Support: First support likely to be at $733. Second one likely at psychological $700.