- Founded in 2017, Arrington Capital is a digital asset management firm primarily focused on blockchain-based capital markets.

Miami, USA, May 23rd, 2025, Chainwire

Over the last 25+ years, Ravi has worked at several major fund alternative fund management companies, including Duquesne Capital Management and Seasons Capital Management

Colton’s unmatched ability to engage with technical founders and his unique insights on the direction of web3 innovation to help Arrington identify the next-gen disruptive startups

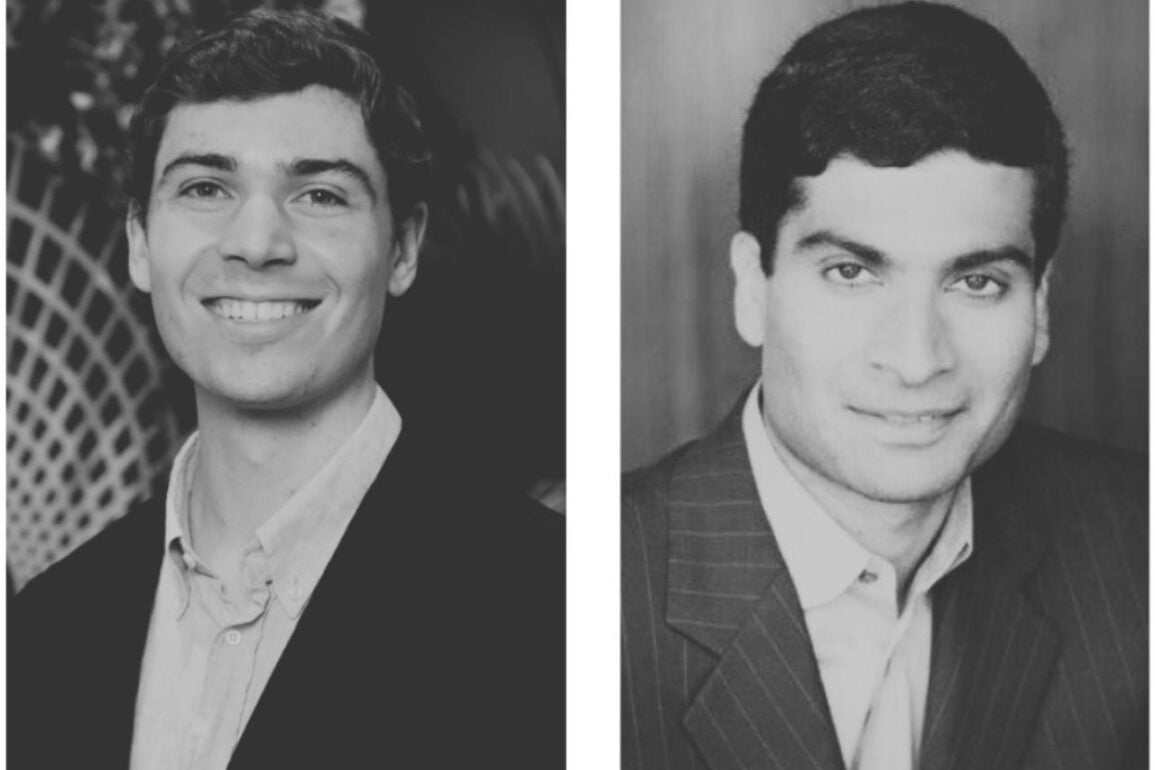

Arrington Capital, a thesis-driven firm investing in digital assets and Web3 since 2017, is excited to announce Ravi Kaza as its new Partner and Chief Investment Officer (CIO) and Colton Conley as a Partner. The appointment of two new partners strengthens Arrington Capital’s investment capabilities as it expands its portfolio and presence across key markets.

Ravi, a seasoned investment professional who has spent the last 25+ years focused on disruptive technologies, has worked in the money management business as a Vice President at Pequot Capital Management and as a Managing Director at Stanley Druckenmiller’s Duquesne Capital Management. In 2003, Ravi founded Seasons Capital Management and helped grow the firm into a multi-billion-dollar, SEC-registered alternative investment manager.

“I have been a long time limited partner and advisor to the fund and enjoy the creativity of the deal structures that Arrington Capital puts together. I look forward to continuing and evolving the legacy of thoughtful investment in liquid markets that has been a part of the fund since inception,” said Ravi Kaza.

Since 2015, Ravi has accumulated significant exposure to digital assets through liquid tokens, venture funds, hedge funds and more than 50 direct investments. Ravi’s stellar background is a strong complement to Arrington’s other fund partners, particularly as the firm continues to expand both its private venture portfolio and liquid trading business. Ravi has been involved in the fund’s recent investments in both Defi Development Corporation ($DFDV) and Nakamoto ($KDLY).

“We’re thrilled to welcome Ravi as the new CIO Partner and promote Colton as a Partner. Ravi’s remarkable track record investing in highly disruptive companies will prove invaluable to our firm, particularly as TradFi and DeFi continue to converge,” said Michael Arrington of Arrington Capital. “In the last couple of years at Arrington, Colton has proven to have a unique insight on the direction of Web3 innovation. His commitment and ability to engage with technical founders is unmatched.”

Colton has been involved in crypto since 2018 and brings a deep understanding of capital markets and DeFi. He previously founded Prime Protocol, a cross-chain lending protocol that raised over $3M in venture capital from Arrington Capital, Framework Ventures and Jump in [2022) before an exit in 2024. Prior to his web3 experience, Colton was a quantitative trader in Global Fixed Income at Citadel after graduating from Yale University.

Having joined Arrington Capital’s investment team as a Principal in 2023, Colton has been successful in identifying early-stage web3 investments and has run point on some of the most exciting investments in the fund’s recent history – such as Redstone, Rilla, Space and Time, and aPriori.

Colton’s track record aligns with the overall goal of Arrington Capital to continue to find and support the best founders as the web3 industry matures. His stellar background as a web3 builder, trader, and early-stage investor has been invaluable to the firm.

“It has been fantastic to work alongside the team at Arrington Capital,” said Colton Conley. “We continue to see unique deals and push the envelope with what is possible and I am excited about what the future will bring for the fund, our upcoming investments, and innovative founding teams.”

About Arrington Capital

Arrington Capital is a digital asset management firm primarily focused on blockchain-based capital markets. The firm, co-founded in 2017 by TechCrunch and CrunchBase founder Michael Arrington, has invested in hundreds of startups around the world. Arrington Capital is a seasoned, international team composed of Silicon Valley veterans and operators with deep venture capital experience and crypto native roots. Arrington Capital’s first fund was Arrington XRP Capital, and has expanded to multiple funds over time. For more information on Arrington Capital, visit https://www.arringtoncapital.com/.

Contact

Arrington Press

[email protected]