The Near coin price has struggled in the past few sessions as investors continue to worry about the tighter monetary environment. NEAR is trading at $9.26, which is bout 48% below the highest level on Thursday. This action brings the total valuation to about $5.3 billion, making it the biggest coin in the world.

The Near Protocol is a fast-growing Ethereum-killer that has approached scalability and speed issues differently. Like Elrond and Zilliqa, Near uses a technology known as sharding. This is a process that increases speed of the network by dividing transactions into several blocks known as shards. The developers launched the so-called nightshade sharding in November.

While the Near coin price has done well since then, there have been concerns about the tightening monetary conditions in most countries. For example, on Thursday, the Bank of England (BOE) decided to hike interest rates by 0.25%. The Federal Reserve has hinted that it will implement three rate hikes in 2022. This means that the year will end with rates being at about 0.75%.

This sentiment has pushed risky assets on edge. For example, on Thursday, the Nasdaq 100 index tumbled by more than 300 points. The index is viewed as a relatively riskier asset because most of its constituent companies are tech firms.

Near price prediction

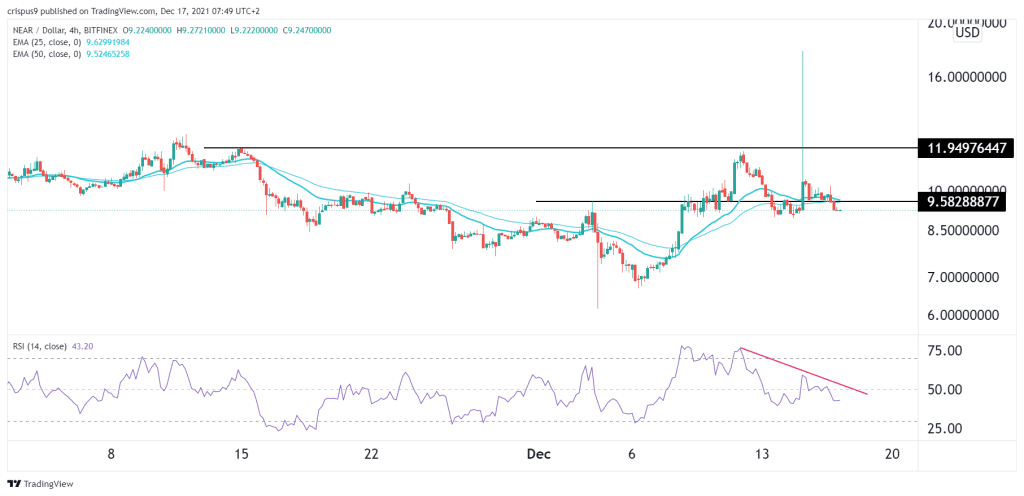

The four-hour chart shows that the Near Coin price popped to a high of $17.78 on Thursday evening. It then quickly erased most of these losses and is currently trading at about $9.26. The coin is slightly below the key level at $11.05, which was also the highest level on November 15th.

It has also moved slightly below the 25-day moving average while the Relative Strength Index (RSI) has moved lower. It is also slightly below the key support at $9.58, which was the highest level on December 3.

Therefore, in my view, I believe that the Near price is down but not out. This means that there is a likelihood that it will rebound in the coming days. If this happens, the coin will likely retest the key resistance at $11. However, a drop below $8.5 will invalidate the bullish view.