The FTSE 100 index rebound continued ahead of the upcoming UK inflation data scheduled on Wednesday this week. It rose to a high of £7,527, which was the highest level since June 9th of this year. It rose by more than 8% from its lowest level this year.

BHP share price in focus

The main catalyst for the FTSE 100 will be the latest earnings by BHP, the world’s biggest mining company. BHP, which is no longer in London, delivered its biggest full-year profit as the volume of commodities jumped.

The firm said that its total underlying earnings were $23.8 billion, which was better than the median estimate of $21.6 billion. As a result, the firm will pay a record dividend of $3.25. The BHP share price jumped in Australia while its tracking one in London is expected to rise. Still, other FTSE 100 mining companies like Glencore, Rio Tinto, and Anglo-American have struggled in the past few weeks.

The FTSE 100 index will next react to the upcoming earnings by companies like Persimmon, Balfour Beatty, AO World, and Watches of Switzerland. Persimmon and Balfour Beatty will provide more color about the housing and construction industry.

Further, the index will react to the latest UK consumer inflation data scheduled for Wednesday. Economists expect the data to show that the country’s inflation jumped to 9.8% in July as the cost of energy rose. Sadly, the UK economy is braced for a major natural gas challenge ahead since it does not have enough gas in storage ahead of the winter season.

FTSE 100 forecast

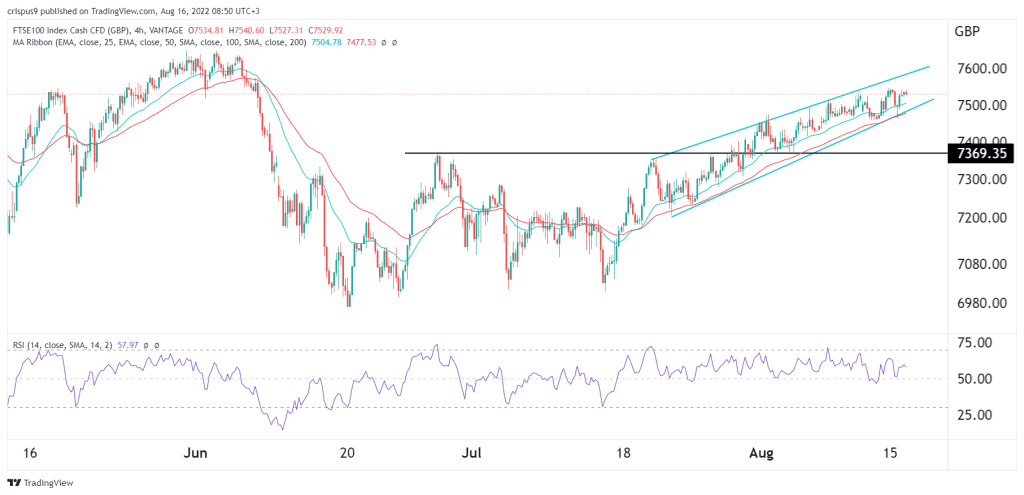

The four-hour chart shows that the FTSE index has been in a strong bullish trend in the past few weeks. This sell-off accelerated when the index rose above the important support level at £7,370, which was the highest point on June 28. It remains above the 25-day and 50-day moving averages.

Therefore, the index will likely keep rising in the near term. If this happens, the next key resistance level to watch will be at £7,600. A drop below the support level at £7,465 will invalidate the bullish view.