The EasyJet share price has been a bit ugly in the past few months as investors worry about the impact of the rising oil prices on the company. The EZJ stock is trading at 553p, about 32% above the lowest level this year. However, it remains about 40% below its highest point in 2022. This performance mirrors other airline stocks like IAG, Wizz Air, and Ryanair.

Like other airline companies, EasyJet has been in a difficult time in the past few months. However, all indication is that the firm’s traffic has jumped in the first quarter as countries move on from the Covid-19 pandemic. As a result, there is a likelihood that EasyJet will publish strong results in the upcoming trading statement and 2022 in general.

However, the company has also seen robust costs, especially in energy. In the past few months, the overall cost of oil has risen sharply, and analysts expect that the price will keep rising. For example, according to IATA, the average price of jet fuel rose to $157 per barrel, which was 137% above the same period in 2021. In Europe, the price rose by over 126%. Therefore, while EasyJet hedges its oil prices, there is a likelihood that costs will keep rising.

Therefore, the next six days will be critical for EasyJet, considering that the firm will publish its trading statement on Tuesday. This will be an important statement since the firm will talk about the rising fuel and labour costs. The company will also update on its recent route additions.

So, what next for the EasyJet share price? Fundamentally, the company is in a blind spot simply because it is unclear how high jet fuel will rise. It is also unclear how the company’s customers will adapt to the rising prices.

EasyJet share price analysis

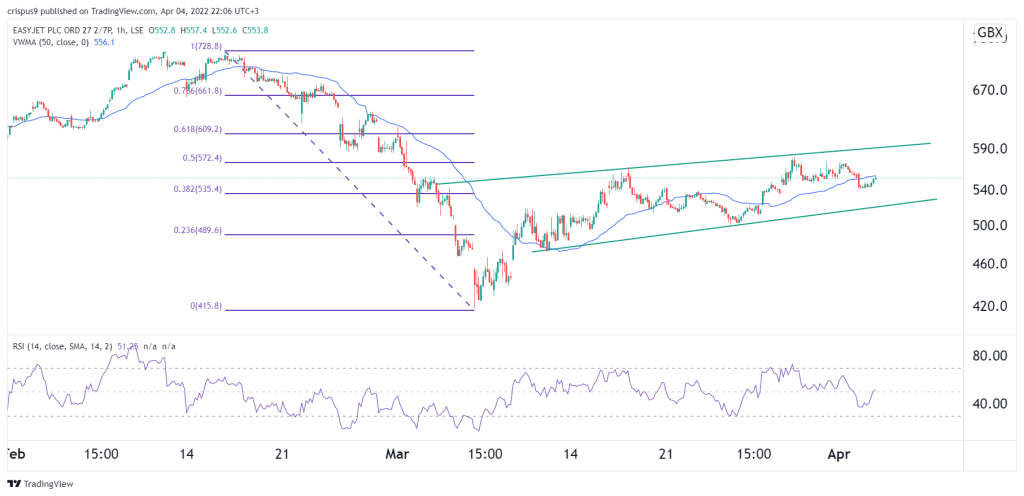

The hourly chart shows that the EZJ share price has been moving sideways in the past few days. In so doing, the stock has formed an ascending channel pattern shown in green. It is currently between this channel and the 50-period volume-weighted moving average. The price is also between the 38.2% and 50% Fibonacci retracement levels.

Therefore, the EasyJet stock price will likely remain in this range as investors wait for the upcoming trading statement. The key support and resistance levels to watch will be at 530p and 590p.