- XRP price has declined significantly this week, going below key support levels. Is this a time to buy and is a near-term reversal likely?

XRP price has been going down over the past week, falling below important moving averages, which is calling for caution. There has been an immense correction across the board in the cryptocurrency market this week. Bitcoin led the way down, going as low as $107,500 after the Fed slashed rates. This pulled other cryptocurrencies, including XRP, down with it. Whales sold off big positions as sell volume rose, with 392 million tokens moved in a surge 658% above average.

Is XRP Price About to Reverse?

One significant driver of the recent decline appears to be a wave of institutional selling pressure, speculation and profit-taking by institutions seem to be a major factor in the recent downturn. As major financial news outlets like Yahoo Finance have pointed out, the collapse below critical psychological support levels set off a chain reaction of sales, especially from bigger traders or “whales.”

This institutional distribution shows that big money is currently booking profits instead of accumulating, which keeps the downward pressure on. For a reversal to happen, the market would have to change its mind and there will have to be a compelling fundamental reason for it to happen.

The ongoing anticipation of a possible XRP Spot ETF is still a major event to watch on the fundamental front. If regulators make good progress on this front, or if such a product is officially launched, it might spark interest from both institutions and consumers, which would be the fuel needed for an increase.

It’s basically about getting people in the market interested again and giving them a good reason to believe that XRP price will go up in the future. As technical evidence that the bulls have reclaimed control, a closing price above the previously identified overhead resistance levels will be required.

XRP Price Chart Technical Analysis

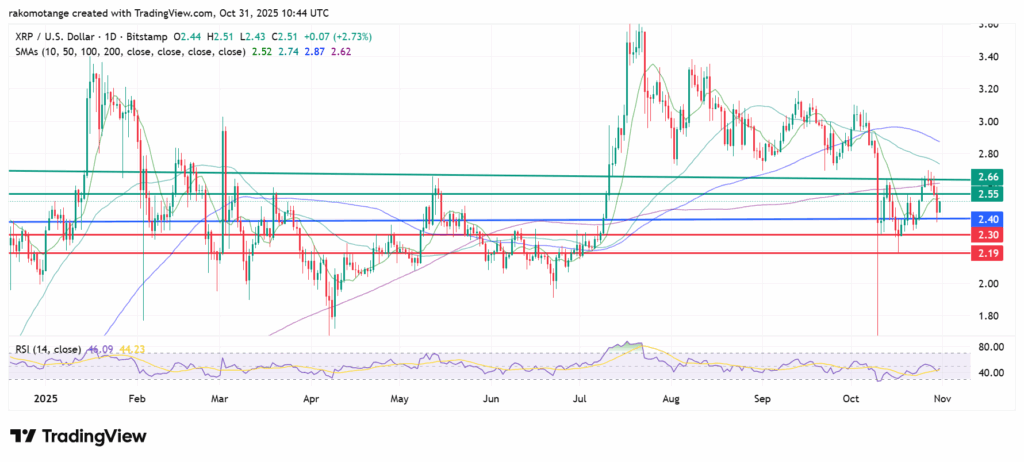

XRP’s primary support is at $2.40 pivot mark. The next support will likely be at $2.30, and going below that level could send the coin low to test $2.19. Primary resistance is likely at $2.55, just above the 10-day SMA. If XRP price clears that barrier, the downward narrative will be invalid and the next target could be at $2.66. The 50-day MA at $2.65 is looking at a death cross with the 200-day at $2.55, which shows that the market is still going down. RSI is oversold at 30, which means it could change direction if volume turns green.

XRP/USD daily chart showing current action below key SMA levels. Source: TradingView

XRP price is mostly being pushed down by a wave of institutional selling pressure and profit-taking. This large-scale distribution from major holders is outweighing buying interest, leading to the sustained downtrend.

Currently, a reversal is heavily dependent on a positive development around XRP Spot ETF. This would inject fresh institutional capital and renew market sentiment.

Yes. Fed interest rate cut shock and a market-wide profit booking currently drives decline, and not weaknesses specific to XRP. Whale dip-buying and ETF hype signal long-term upside.