- Ethereum price has established support at $3,500 and the $80 billion DeFi TVL -the highest in three years-underscores bullishness.

Ethereum price rose to six-month highs of $3,676 on Friday, with the momentum signaling the likelihood of an extended upside. The crypto coin has gained 24% in the last week, far-outweighing market bellwether Bitcoin’s 3.7% rise in the tame time frame. The uptick is accompanied by a strong ETF inflow, with the nine US-traded Ethereum spot ETFs having brought an average of about $370 million per session in the last seven sessions.

Meanwhile, BlackRock recently filed an application to be allowed to include staking in its spot Ethereum ETF. That means investors, including institutions can now earn not just from ETH price exposure, but also from yields. This has made ETH more attractive and could result in a substantial spike in its demand. About 28% of all circulating ETH valued at about $90 billion is now staked since Pectra upgrade, underlining the attractiveness of yield-based investments. In addition, the scarcity created by locking up coins provides tailwinds for further gains.

Ethereum price upside is likely to continue in the near-term, considering that the recent price uptick is accompanied by rising trading volume. According to CoinMarketCap, ETH’s trading volume was up by 10.7% in the last 24 hours, affirming bullish appetite. Meanwhile, DeFiLlama data shows that Ethereum chain’s Total Value Locked (TVL) rose by 7% in the last 24 hours, hitting three-year highs of $80.784 billion and pointing to the coin’s rising utility.

Ethereum Price Prediction

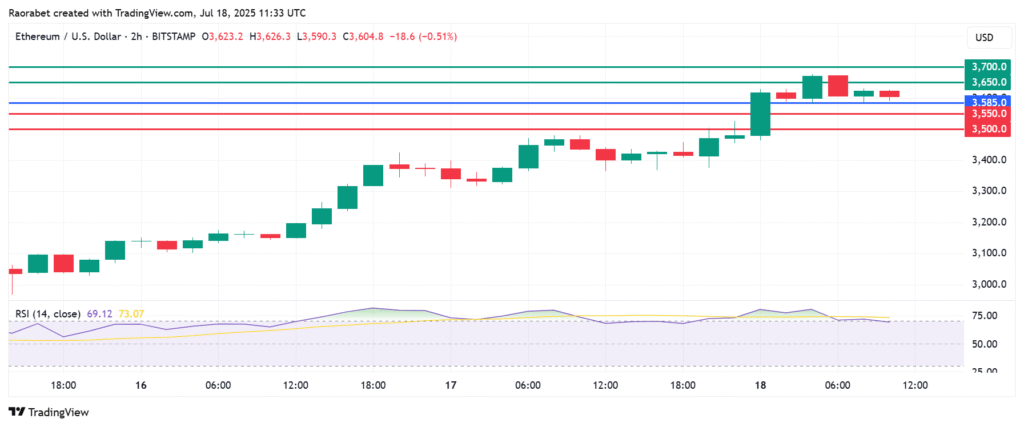

Ethereum price pivots at $3,570 and the momentum calls for further upside. The coin will likely meet initial resistance at $3,600. However, if the buyers extend their control, the momentum could extend gains to test $3,680.

Conversely, breaking below $3,570 will shift the momentum towards the downside. That will likely see initial support established at $3,560. The upside narrative will be invalid below that level. In addition, a stronger momentum could push ETHUSD lower and test the second support at $3,550.