- Discover how geopolitical tensions rally silver prices, along with a monthly technical outlook for XAGUSD, and key market movers.

The escalating geopolitical tensions in the Middle East and the weaker US Dollar support the white metal. Silver price attracts some buyers to reach the $36.30 level during the Asian session today. All eyes are on the data will be released later on Thursday: the US producer price index and the US initial jobless claims.

The main Silver Price movers:

- US inflation rates in May came softer than expected, which led traders to raise their bets on a Federal Reserve rate cut, driving the US Dollar down and lifting the commodities quoted by the USD.

- The CME Fedwatch before the US CPI data showed that: 68% possibility that the Federal Reserve would cut rates by 25 basis points by September, compared with 57%.

On the political side:

- The United States is planning a partial evacuation of its embassy in Iraq and will let military dependents leave from Middle East or any around places due to the security risks there.

- Investors seek more holdings in white metal because it’s considered a safe-haven asset to hedge against these geopolitical risks, spiking silver prices.

- On the other hand, Steve Witkoff from the white house will meet Iranian Foreign Minister Abbas Araghchi on Sunday in Muscat to discuss the Iranian response to the recent US proposal, thereby any positive developments for the deal over the nuclear program between Iran and the US could cap the uptrend for silver.

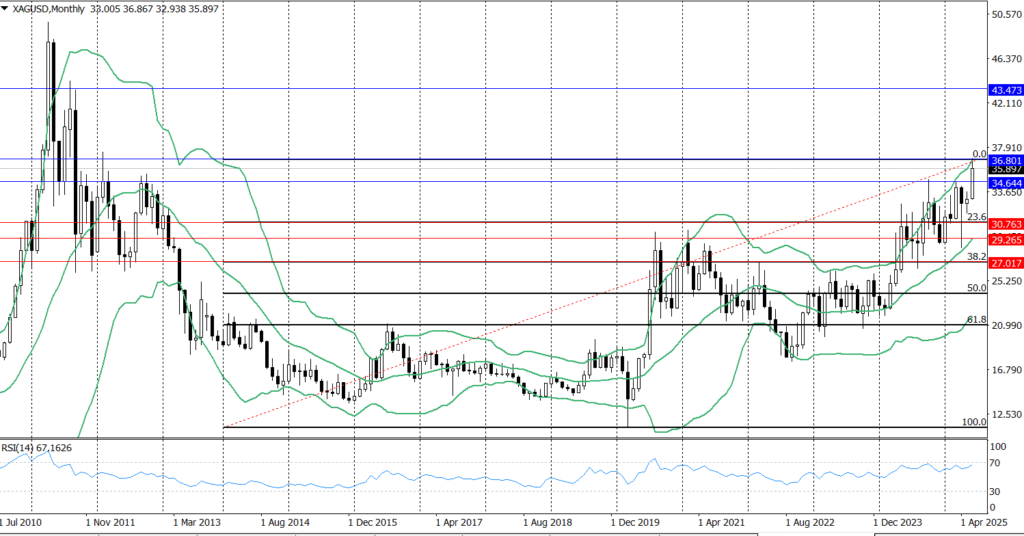

Silver Price Prediction: (The Technical Outlook- Monthly time-frame)

Let’s look at the silver from a broader perspective. The silver price rallied to $36.90. This rally was supported by the resistance, which turned out to be a key support level at $34.64. The bullish scenario remains favored. However, the silver price is too close to the psychological level of $40.00, acting as a major resistance for the XAGUSD . Any breakout above the psychological level could support the price to reach higher levels towards $43.47, a level not touched since 2011. Reaching this level requires a clear close above the $39.00 level.

The 14-day Relative Strength Index (RSI) reaches too close to the 60.00 level, after reaching the overbought area, indicating that the RSI will resume the upside, anticipating that the near-term trend is bullish.

On the bearish side, if the silver loses its momentum and retests the key support level at 34.64 again, any break below this level could confirm a bearish trend, potentially reaching another psychological support level at $30.76 based on the 23.6 % Fibonacci retracement.