- Discover the silver price prediction and the factors that are influencing the price movements with a technical outlook.

During the Asian trading session on Thursday, the silver price (XAGUSD) rose to near $32.60 per troy ounce, gaining ground for the third trading session. Nowadays, precious metals are attracting investors amid the rising geopolitical tensions and growing concerns about the fiscal policy of the United States.

Factors that fueled silver prices to rally:

- The downgrading of the US credit rating from Aaa to Aa1 by Moody’s, which follows similar downgrades by Fitch Rating in 2023 and Standard & Poor’s in 2011.

- The US national debt is expected to rise to around 134% of GDP by 2035, from 98% in 2023, with a budget deficit expected to widen to nearly 9% of GDP. According to Moody’s expectations.

- The ongoing geopolitical tensions in the Middle East, raising the uncertainty sentiment in the market, which drives investors towards safe-haven assets like silver.

- Benjamin Netanyahu said that Israel would charge ahead with a military campaign to gain total control of Gaza. which indicates to rise in tensions in the Middle East as well.

- Additionally, Ukraine is set to ask the European Union to seize Russian assets next week. and put sanctions on some oil buyers.

- Since President Trump eased the tightening sanctions, it is expected that Ukraine will present an unreported white paper to the EU, to ask the 27 member countries to take an independent position on sanctions.

Technical Outlook for the Silver Price:

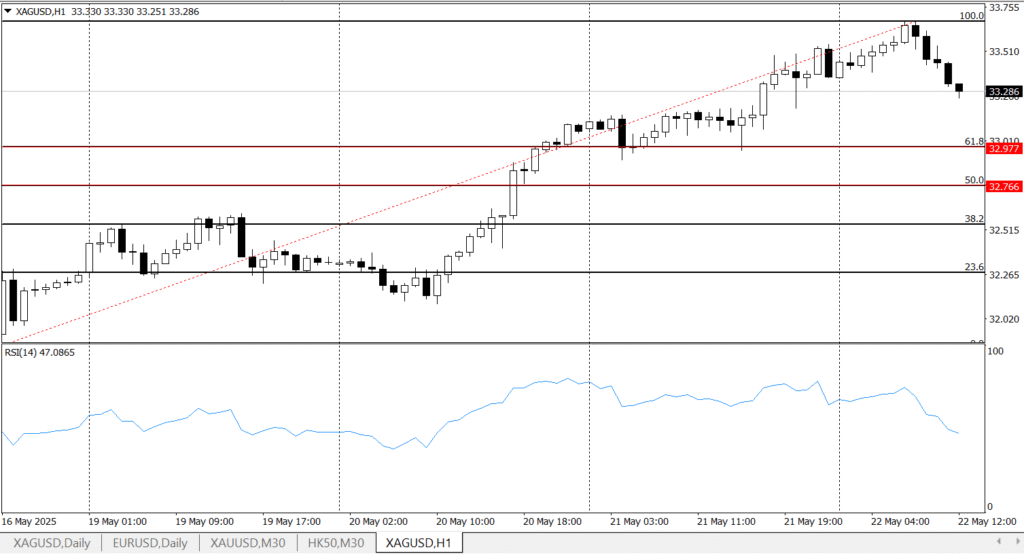

From the technical perspective, the silver price is now trading under the pressure of a strong resistance level of $33.76 on the 100% level of Fibonacci. The price is going towards a strong support level of $32.97. If the price can not break through this level, it may go up again towards $33.76.

On the bearish side, any break through the support level of $33.97 could drive the price down to reach lower levels such as $32.76 and then $ 32.50.

Last week’s silver price prediction. Check out there: Silver Price Forecast: XAG/USD Extended Its Gains, will the rally last?

Gold-Silver-Ratio:

The GOLD-SILVER-Ratio is too close to its psychological level of almost 106, which is never exceeded. Now, the ratio is 99:56, which means that it takes 99 ounces of silver to purchase one ounce of gold. As of early July 2024, the ratio was 87:1, and historically, this ratio has typically ranged between 40:1 and 60:1, indicating that the current ratio is relatively high, suggesting that silver may be undervalued compared to gold. What does this indicate?, high ratio can indicate potential for silver prices to rise and continue their rally.