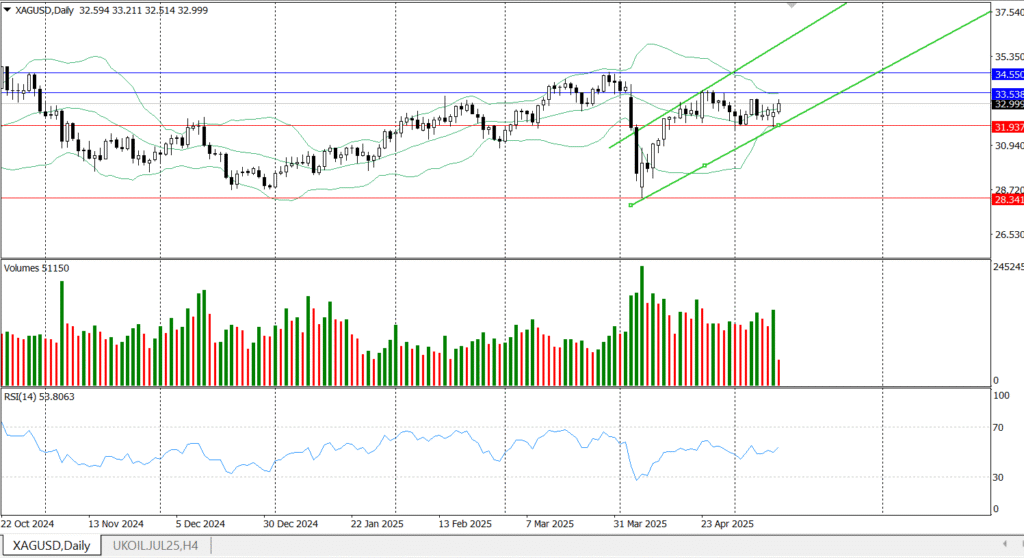

- As the silver prices are going up, we listed the technical levels for XAGUSD pair . discover the silver price prediction.

Silver price permits a bullish outlook today on Tuesday, 13th May, and it extended its gains to be trading at the time of writing, almost $33.00 per troy ounce. According to the technical outlook of this precious metal, XAGUSD, it continues to trade within an ascending channel pattern.

Technically, the silver price is trading now above a strong support level of $31.93, which may push the price to reach the resistance level at $33.53. Any break above this resistance level could attract buyers and support the silver to approach the seven-month high at $34.55. Silver Price Prediction 2025-2040

On the downside, the silver price may test the support level of $31.93, so any breakdown of this level may expose the silver price to the bearish side and put pressure on the XAGUSD pair to test the eight-month low of $28.00, reached on April 7.

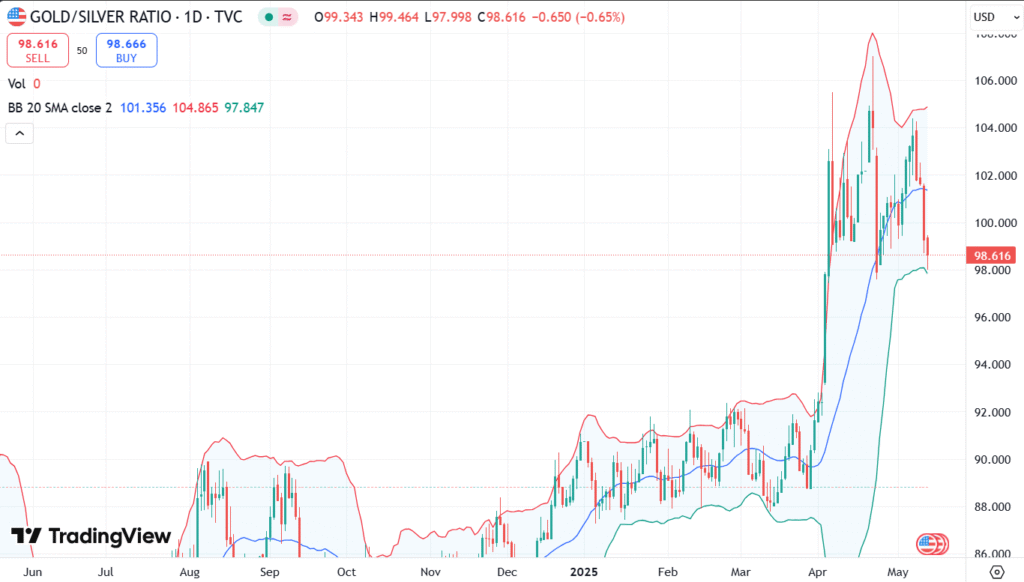

Gold-Silver Ratio

This ratio tells the investors how many ounces of silver it takes to buy one ounce of gold. A steadily increasing ratio might suggest that gold is becoming more expensive than silver, while a decreasing ratio could indicate the opposite.

Now, the ratio is 98:1, which means that it takes 98 ounces of silver to purchase one ounce of gold. As of early July 2024, the ratio was 87:1, and historically, this ratio has typically ranged between 40:1 and 60:1, indicating that the current ratio is relatively high, suggesting that silver may be undervalued compared to gold. What does this indicate?, high ratio can indicate potential for silver prices to rise and continue their rally.

It’s useful to always check the gold-silver ratio, but please be advised that it’s not a crystal ball. It’s one tool among many and should be used alongside other fundamental analyses

What are the factors affecting Silver Prices?

There is are wide range of factors affecting silver prices. Such factors as geopolitical uncertainty or fears can make silver prices go up, as it’s a safe-haven asset.

Lower interest rates may also raise silver prices. Its moves depend on the strength of the US dollar. So, high interest rates will strengthen the dollar and weaken the silver. Other factors, such as demand and supply for mining, could affect silver prices and recycling rates as well. Watching all of these factors may help investors while performing a silver price prediction.