The Chainlink price has been under intense pressure as the cryptocurrency industry struggles. LINK, its native token, has dropped to $18.38, which is about 52% below the highest level on November 11th. Its total market capitalization has declined to about $8.8 billion.

Chainlink is one of the most important blockchain projects in the world. It is used by most developers to connect real-world or off-chain data to the blockchain. For example, using the network, a developer can easily implement data about a school or a company’s supply chain to the blockchain. It also has a feature known as a random number generator (RNG) for smart contracts.

Like all cryptocurrencies, the LINK price has been in a strong bearish trend in the past few months. The main reason, in my view, is that investors are concerned about the Federal Reserve’s hints that it will hike interest rates in the coming year. As a result, Chainlink and other assets like stocks have also retreated.

Chainlink price prediction

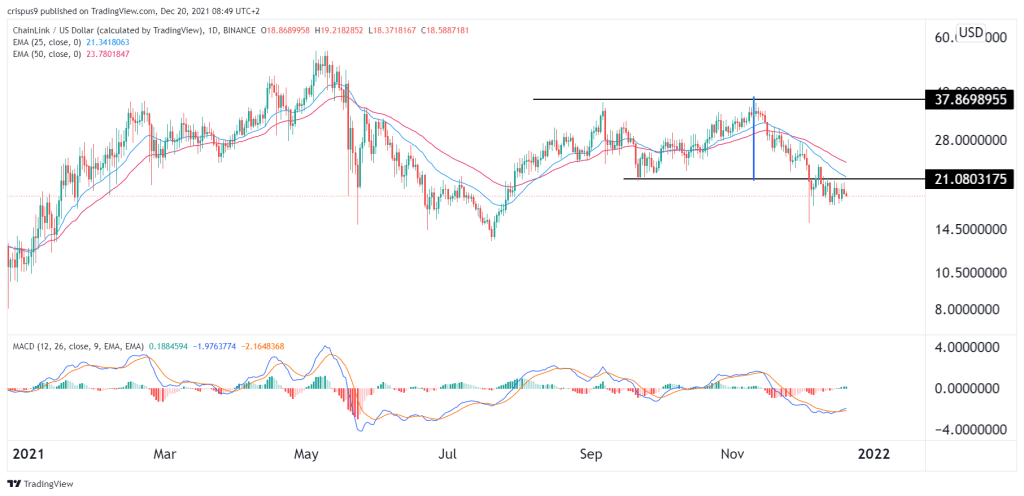

The daily chart shows that the Chainlink price formed a double-top pattern at $37.8 between September and November. A double-top pattern is usually a bearish sign. The price is even slightly below the chin of the double-top pattern. At the same time, the coin has moved slightly below the 25-day and 50-day moving averages. The MACD has also moved below the neutral level.

Therefore, there is a likelihood that the LINK price will break out lower as bears target the key support at $15. This view will be invalidated if the price rises above $25.