Binance Coin price predictions are starting to turn bearish after the US Securities and Exchange Commission (SEC) said it was investigating Binance.US over broker-dealer activity allegations. Bloomberg has reported that the SEC is looking at the market-maker ownership stakes of Binance CEO Changpeng Zhao and whether the exchange is carrying out broker-dealer activities.

Under US law, any company conducting broker-dealer transactions must be authorized to carry out such activities by the relevant regulators (SEC and CFTC). The announcement of the investigation comes soon after a Reuters exclusive report alleged that the Binance exchange was serving as a cleanup venue for laundering billions of illicit funds, including crypto funds stolen by the North Korean state-sponsored Lazarus Group.

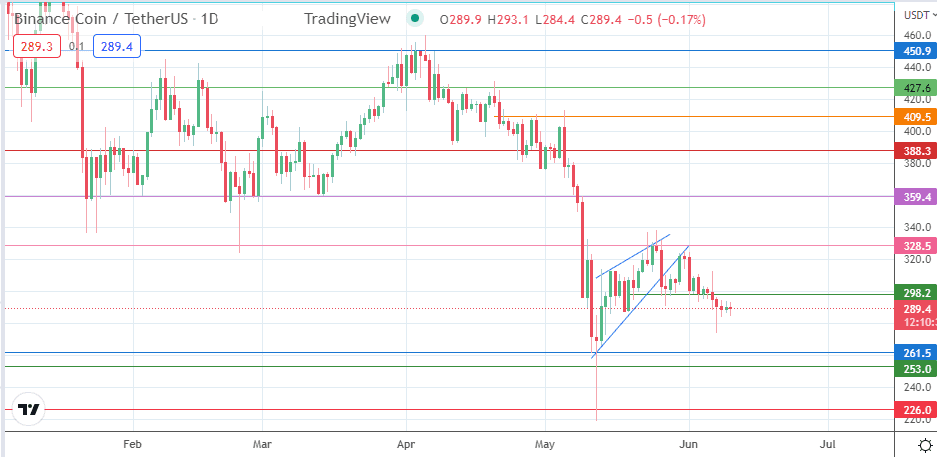

The Reuters investigative report also accused Binance of being a channel for sales of illicit drugs and investment frauds. These news events have triggered the BNB/USDT’s steady decline below the 25 May high at $337. This decline continues to fuel new bearish Binance price predictions as the price action pushes steadily to the south following the rising wedge’s breakdown.

Binance Coin Price Prediction

The breakdown of the rising wedge and the 298.2 support level has opened the pathway towards the 261.5 support, which serves as the next downside target. This price level also marks the point of completion for the wedge’s breakdown move.

Additional support below this level comes in at 253.0, the previous low seen on 22 March 2021 and 24 June 2021. 226.0 is another psychological support level formed by the previous lows of 25 March and 22 June 2021.

On the other hand, the bulls will need a recovery above the 328.5 resistance to push for an advance that will eventually test the 359.4 resistance (3 February and 13 March 2022 lows). Additional targets to the north are seen at 388.3 (31 January high) and at the 409.5 confluence of the late April highs.

BNB/USDT: Daily Chart