Yearn Finance price has continued having momentum in the markets, with today’s prices down by almost five per cent. The drop is also a reversal of yesterday’s price gains of 7 per cent. In the past three trading sessions, Yearn Finance has also been in a sideways market, with most trading sessions closing the markets with an alternate trend move from the previous day.

A look at Yearn Finance Past Trading sessions.

Since July 26, Yearn Finance has doubled in price. At some point during that period, Yearn Finance was also up by 130 per cent. During that period, Yearn Finance had also seen some aggressive trading sessions, including on July 28, when prices surged by 27 per cent and on July 29, when prices surged by almost 20 per cent.

The strong and aggressive push to the upside has also, in some trading sessions, traded against the general cryptocurrency market trend. For instance, in much of the period between July 26 and today, there had been a few aggressive pushes to the downside of the cryptocurrency market, which at some point even dropped below $1 trillion again. However, the yearn Finance Protocol continued its strong bullish push to the upside.

Part of the reason is due to new investors coming and investing in the project. Looking at the historical data, before July 24, almost all trading sessions had a trading volume of less than $100 million. However, the trading volume has since surged, topping on July 30 with a trading volume of $500 million.

Yearn Finance Price Prediction

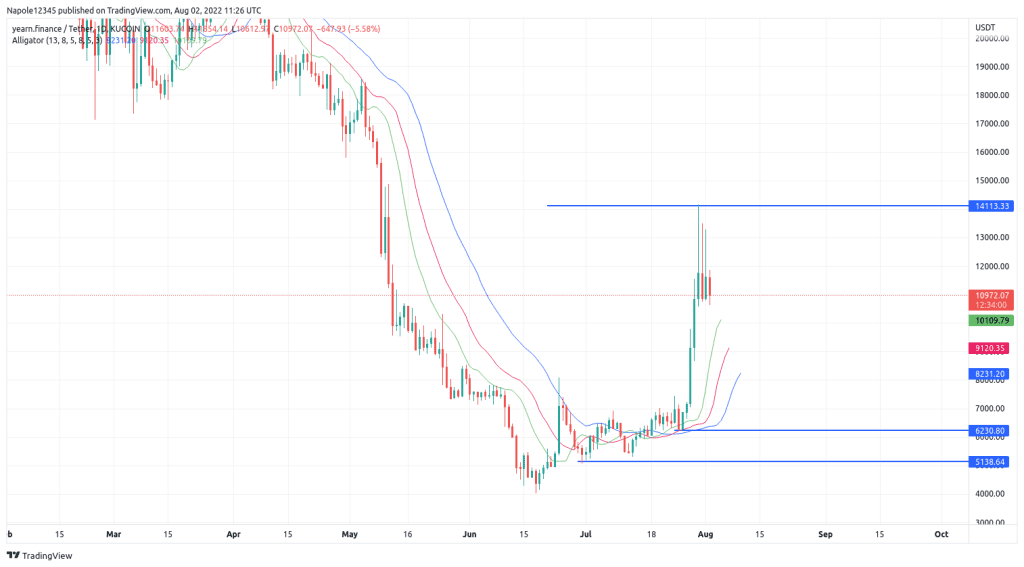

Therefore, looking at the chart below, we can conclude that the strong bearish move we saw in the past few days has slowed down. Part of the reason is due to the loss of trading volume. Today, the momentum looks to have disappeared, with markets trading in a sideways market.

However, despite the trading volume falling, it is still higher than when the current surge started. Therefore, I expect the prices to continue trading in a sideways market. There is a high likelihood that, when the sideways trend ends, the prices will resume the bullish trend.

Therefore, I expect prices to hit the $14113 price level again, and this time, to have enough momentum to trade above the resistance level. However, should the prices trade below $10,000, another bearish trend will likely be high. My bullish trend will also be invalidated.

Yearn Finance Daily Chart