The Royal Mail share price (LON: RMG) pulled back on Monday and Tuesday after last week’s rally failed to clear trend-line resistance. This morning, RMG is slightly softer at 433p (-0.09%), paring this month’s gains to just +1.70% and potentially setting up a return to trend line support.

This year has been a game of two halves for RMG shareholders. Between January and June, the share price gained 78% to a three-year high of 613.8p. However, since then, RMG has been trending broadly lower. As a result, the year-to-date performance has dropped to +24%. However, the price has formed a base above 400p and was close to clearing a significant hurdle last week before reversing. But whilst this is encouraging, until the share price breaks higher, the odds of it breaking down increase.

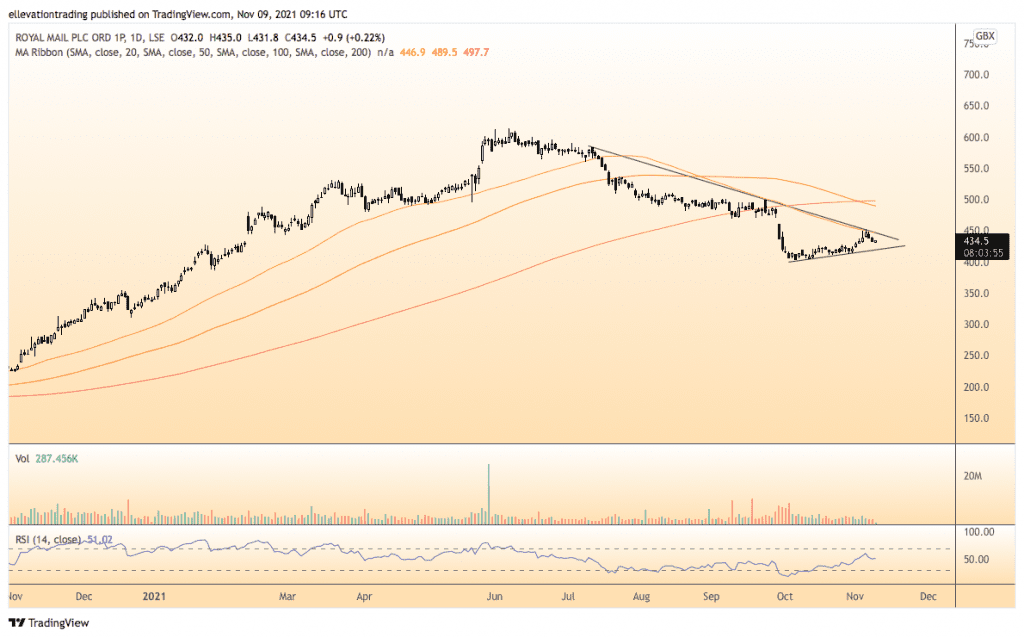

RMG Price Analysis

The daily chart shows the Royal Mail share price is below a descending trend line at 450p and the 50-Day Moving Average at 446.8p. In my opinion, a successful clearance of the confluent resistance would be bullish, potentially targeting the longer-term moving averages just below 500p. However, the price is on track for its third consecutive daily loss, bringing immediate support into focus.

If RMG falls below the rising trend-line support at 420p, bearish momentum should drive it lower towards the psychological 400p level. And if 400p give out, the next level to watch for is 350p.

Whilst RMG is sandwiched between support and resistance, it’s hard to choose which scenario will play out. Traders should therefore monitor the price action until a more precise picture emerges.

Royal mail Share Price Chart (Daily)

For more market insights, follow Elliott on Twitter.