Rishi Sunak has outlined a massive cash injection for new affordable homes in today’s Autumn Budget in a huge boost for prospective buyers and the UK property market.

The Taylor Wimpey share price is higher on the news and it has come at the right time after a recent downturn in the price.

The Chancellor announced a “multi-year housing deal totalling nearly £24billion” in today’s Budget. The plans include an investment of £11.5billion to build up to 180,000 new affordable homes, which would be the largest cash investment in a decade. The Government will also be supporting a move to bring 1,500 hectares of brownfield land into use.

The news is a shot in the arm for the country’s housing sector which will have been affected by a pending interest rate hike by the Bank of England as early as next week.

Taylor Wimpey Price Forecast

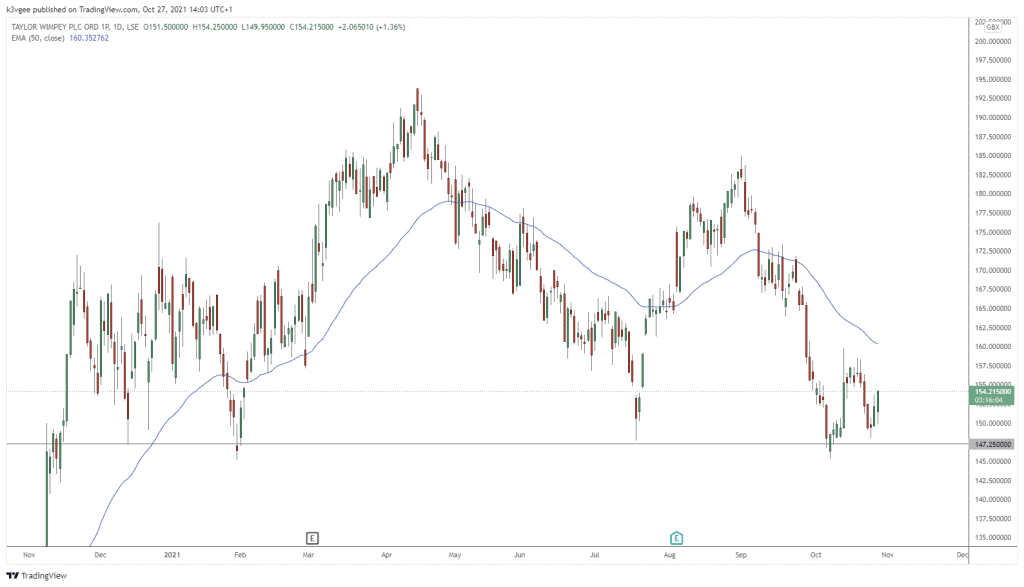

The price of TW. has found solid support around the 147.5p level on four occasions dating back to the start of 2021. This level provided a base for the current move to 154p and today’s gains on the budget could signal the start of a revival. Clearing 158.50p would set up the potential for a larger move higher towards 170p.

Taylor Wimpey Price Chart (Daily)