This Monday, the Lloyds share price has opened on a negative note as the markets make an underwhelming start to the week. The recent decline in Lloyds’ share price is a paradox, given that interest rates have started to climb. Rising interest rates raise profit margins on banks’ lending portfolios. As a result, the stock has declined despite the bank providing an improved profit forecast in late April, taking it down 15% in 2022.

The problem appears to be how UK inflation has impacted the consumer. Consumers tend to cut down on any form of spending deemed unnecessary for survival. Consumers also reduce loan-taking activity when interest rates start rising.

Lloyds Banking Group is seeing a trend in which subscriptions for some of its paid services are starting to drop off. A drop in consumer spending in times of inflation is a trigger for an economic slowdown. Bets are on board for a downturn in the UK economy, and this has led to a 2% drop in the value of the British Pound in recent days. Reduced spending on paid services and the impact of a devalued pound could make nonsense of any earnings the bank makes. Short term, this could hurt investor sentiment.

However, the Lloyds Banking Group has a diversified portfolio. It is heavily exposed to the UK housing market, which is currently red-hot. It is on course to beat its earnings forecasts down the road, which could lead to a recovery in the Lloyds share price.

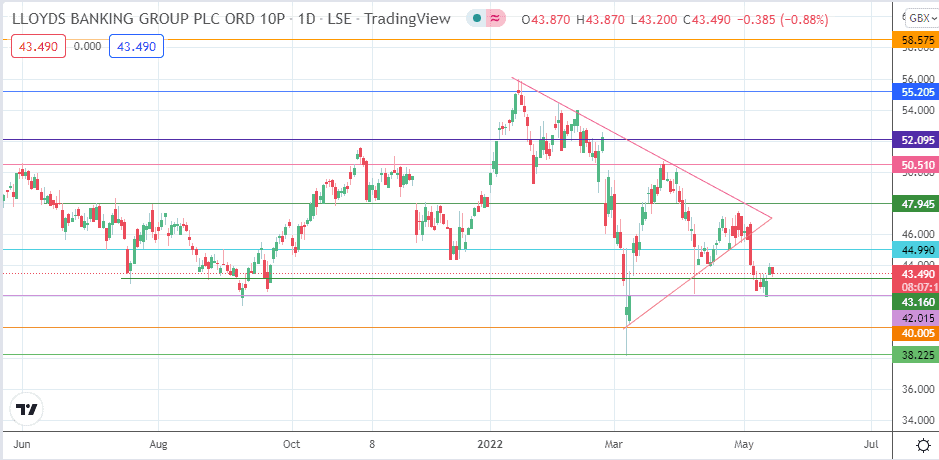

The decline from the symmetrical triangle’s breakdown found support at the 43.160 price mark. However, there has been little recovery since, and this morning, the Lloyds share price has found itself under renewed pressure.

Lloyds Share Price Outlook

The intraday decline is challenging support at the 43.160 price mark. If the bears degrade this support, the 9 September and 12 May low at 42.015 becomes the next available target. Below this level, 40.005 is psychological support which comes into the picture, having been a site for the previous lows of 5 March 2021 and 8 March 2022. Finally, if further price deterioration occurs, the 26 February and 7 March lows at 38.225 will become a new southbound target.

Conversely, a support bounce targets the 44.99 resistance initially before 47.945 enters the picture if there is additional price appreciation. Above this level, other barriers to the north exist at 50.51 and 52.095 (6 January and 18 February highs).

Lloyds: Daily Chart