The Facebook share price could have a turbulent trading session Friday, days after the company, now known as Meta Platforms, reported a decline in revenue for the first time in its history. The company reported Q2 2022 revenue of $28.8 billion, representing a 1% drop in revenue. Total profit fell 36% to $6.7 billion, despite growing its daily users to 1.97 billion.

Intense competition from rival apps such as TikTok, a fallout from Apple’s “Ask Not to Track” privacy feature, and a slowdown in the ad tech industry are factors seen as being responsible for the drop in earnings. Some analysts have projected that the company’s revenue could fall even further despite Facebook’s positive forward guidance.

The bounce seen in Thursday’s price action came amid solid Q3 advertising revenue guidance issued by the company along with its Q2 earnings. However, analysts at Morgan Stanley question the ability of the company to achieve this outlook amid a weakening macro environment and higher labour costs from Facebook’s recent onboarding of 5,000 employees.

However, the analysts see a slowing headcount growth in H2, keeping with current industry realities. This pessimistic outlook by the investment bank could dampen sentiment on the stock when it opens for trading on Friday. The Facebook share price is presently down 5.22% in premarket trading, pointing to a lower open.

Facebook Share Price Outlook

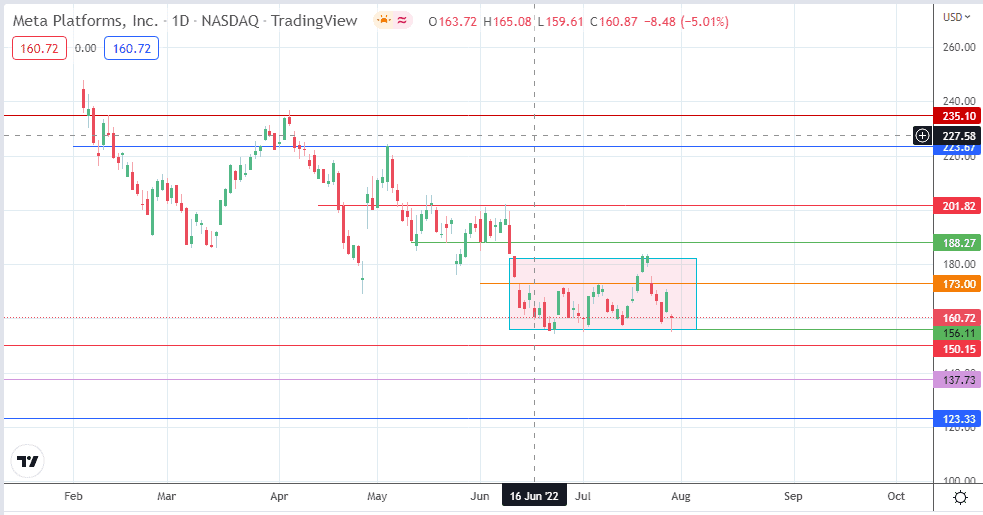

The bounce off the 156.11 support level (23 June low) puts the stock on the path toward recovery, with 173.00 (13 June and 7 July highs) serving as the immediate upside target. Clearance of this price mark and the 21 July high at 183.85 price level sends the stock to a new upside target at 188.27 (20 May and 2 June lows). Above this level, additional upside targets are seen at 201.82 (8 June 2022 high) and 223.67 (4 May 2022 high).

On the flip side, a downside risk to the Facebook share price presents itself if the 156.11 range floor breaks down under bearish pressure. This breakdown move supports the potential for a measured move toward the 150.15 pivots (26 March 2018/11 October 2018 lows). This move must also clear the intervening barrier at 156.11 (1 July 2022 low). Additional targets to the south are seen at 137.73 (18 March 2020 low), along with the 21 December 2018 low at 123.33.

META: Daily Chart