Amazon’s stock price dropped by 1.52 per cent in yesterday’s trading session, continuing a strong bearish trend that has persisted for the past three weeks resulting in a 13 per cent drop in the company’s value.

The Amazon stock price has continued to face pressure due to the rising cost of living in the US due to rising inflation. According to the latest inflation data, the US is experiencing an inflation rate of 8.5 per cent, which has seen most people having to cut their spending, which has greatly affected retail stores such as Amazon.

The company’s decision to get into video streaming services is also coming under heavy pressure. Recent reports indicate the competition continues to grow fierce, with Walmart also launching their own video streaming platform Walmart+, which is expected to be $50 cheaper than Amazon. Today, Amazon enjoys an impressive 150 million subscribers in the US alone, whereas Walmart+ has only 11 million customers. Therefore, losing market share to platforms such as Walmart+ will be a big blow to the company.

Amazon Stock Price Analysis

Despite the worsening inflation and the threat of facing competition in some of its divisions, Walmart is a big enough company to withstand most market forces. The e-commerce giant has massive business operations in other areas such as retail, advertising, cloud services and other services, which can help its share price continue growing despite what is happening in the markets.

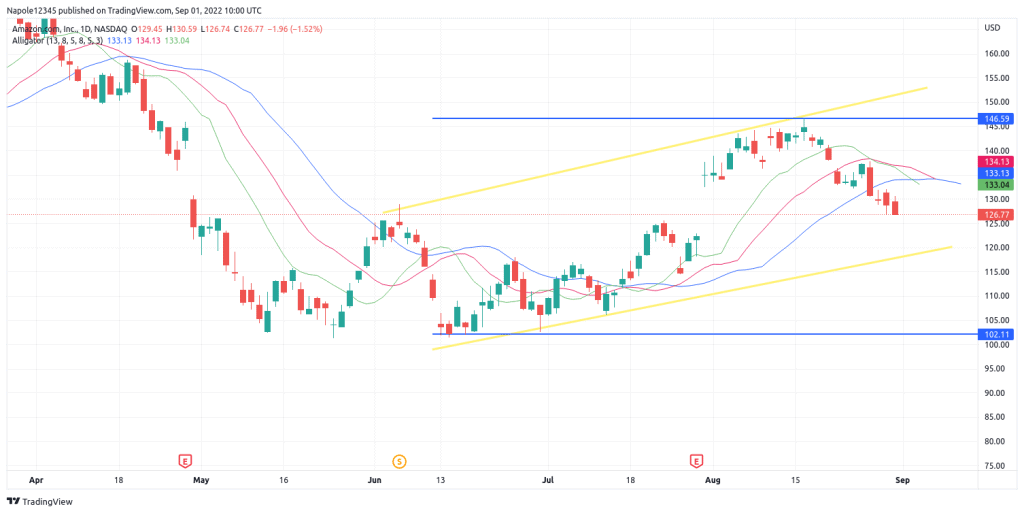

Looking at the daily chart below, we can see Amazon stock has dropped by 13 per cent in the past two weeks. Yesterday’s session was also an extension of the long-term bearish trend. However, despite the drop, my Amazon stock price outlook is still on the upside. I expect in the next few trading sessions, the bullish trend to continue. There is a high likelihood that we may see the stock trading above the $150 price level. My analysis will only be invalidated by the company trading below the $110 price level.

Amazon Daily Chart