The Lloyds share price is not trading today as there is a UK bank holiday to mark the Summer Bank Holiday. This may have given the stock some respite after it fell heavily on Friday, 26 August. The day before, Down Detector reported that many Lloyds bank customers had complained of an app outage, something the bank confirmed in a tweet. The outage affected hundreds of users on the Halifax and Bank of Scotland platforms, which the bank owns.

This outage also coincided with a massive shakeup in the bank’s board. Three new executive committee members have been appointed. Jayne Opperman, John Winter and Laura Needham are joining the board as Chief of Consumer Relationships, Chief Operations Office of Corporate and Institutional Banking and Chief Internal Auditor, respectively.

In other news, the UK financial regulator has ended its probe of certain former senior managers of Lloyds Bank’s bankrupt subsidiary HBOS, with no further action to be taken. HBOS failed in 2008, and the managers faced potential bans from other roles within the UK financial services industry.

Trading resumes tomorrow, where the Lloyds share price could extend its downward streak following the formation of a bearish candle. However, technical plays will be the predominant factor prior to the 15 September Bank of England rate decision.

Lloyds Share Price Forecast

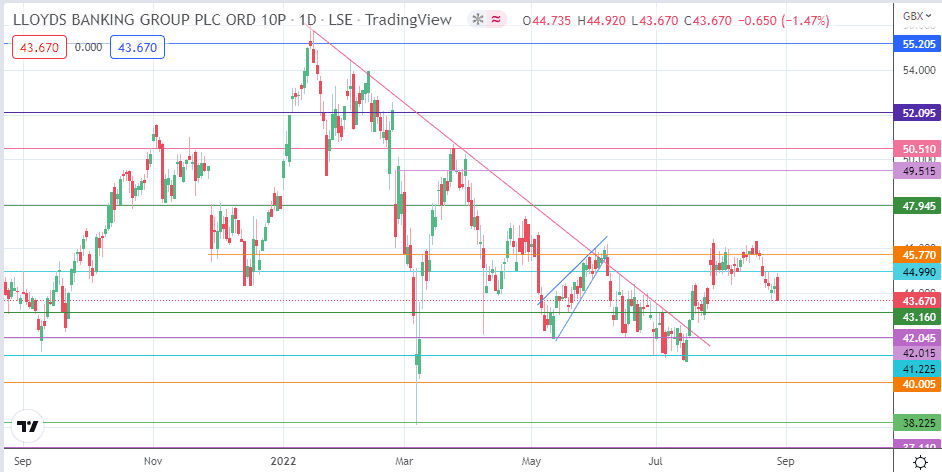

Friday’s steep drop has formed a bearish engulfing candlestick pattern combined with the preceding candle. This favours a continuation of the downside move. This move targets the 43.16 support level, where the price formed previous lows on 16 May and 27 June 2022. An extension below this support brings 42.015 into the picture.

A decline toward 41.225 (30 June and 7 July 2022) is on the cards if the bulls fail to defend the support at 42.015 (12 May and 18 July lows). 40.005 is a psychological support level last seen on 11 March 2021, forming another target to the south.

On the flip side, the bulls would find some joy if they could force prices above the recent confluence of highs at 46.285. This would follow a break of 44.99 (25 April low and 23 August high). If the bulls clear 46.285, this would give them access to 47.945 (14 March 2022 high) before 49.515 (1 March 2022 high) becomes an additional target to the north. 50.510 remains a viable upside target, last seen on 22 March 2022.

Lloyds: Daily Chart