The VIX index continued its bearish trend as American stocks made a strong rebound. It dropped to a low of $20 on Monday morning, which was the lowest point since May this year. It has fallen by more than 42% from its highest point this year, while the top indices like the Russell 2000, Dow Jones, and S&P 500 have recovered. As a result, the fear and greed index has moved to the neutral point.

Fear and greed index rises

The VIX index is a closely-followed tool by investors and even policymakers. It is a volatility index that tracks key options numbers in the S&P 500. It usually has an inverse relationship with key American indices like the S&P 500 and Dow Jones.

American indices have made a strong recovery in the past few days as investors focus on the latest corporate earnings from the US. According to FactSet, 87% of all companies in the S&P 500 have released their results. Of these firms, 75% had a positive EPS surprise, while 70% had a positive revenue surprise.

Further data showed that the blended earnings growth rate for these firms was 6.7%, which was the slowest rate since Q4 of 2020. In addition, the forward PE ratio of the S&P 500 is 17.5, which is lower than the 5-year average.

The VIX index also dropped even after the strong US jobs numbers. The data revealed that the American economy added over 528k jobs while the unemployment rate dropped to 3.5%. As such, the Federal Reserve will likely continue hiking interest rates in the remaining meetings of the year.

Meanwhile, the fear and greed index has bounced back from the YTD low of less than 10 to the neutral point of 50.

VIX index forecast

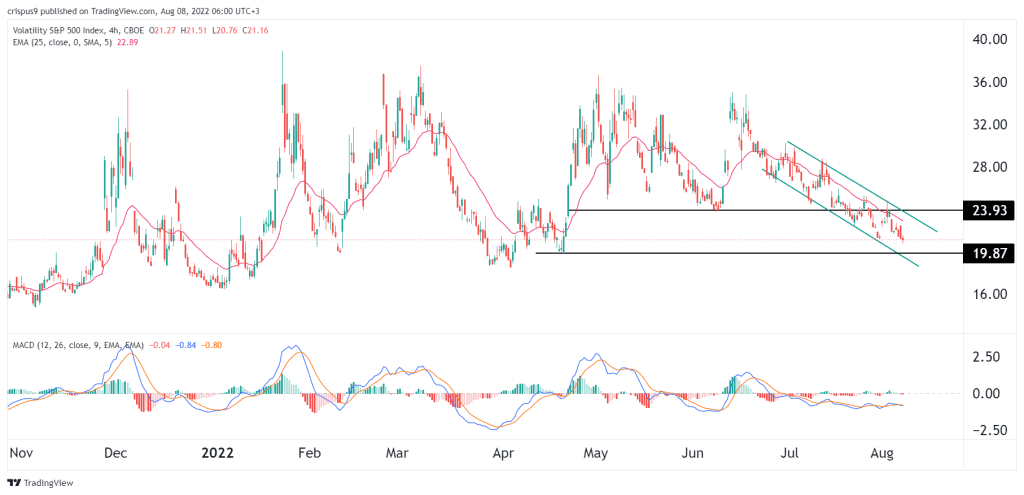

The four-hour chart shows that the VIX index has been in a strong bearish trend in the past few weeks. It managed to drop below the important support level at $23.93, which was the lowest point on June 8th. The index has dropped below the 25-day and 50-day moving averages, while the MACD is below the neutral point.

Therefore, the CBOE volatility index will likely continue falling as sellers target the key support point at $15. This was in line with my previous analysis on VIX. A move above the resistance at $23.93 will invalidate the bearish view.