The USDSEK has dropped to 2-year lows on the back of further weakness on the US Dollar, as well as an expansion in manufacturing activity. Swedish Manufacturing PMI data for August as released by Swedbank showed that business conditions around manufacturing improved from 51.4 in July (revised upwards) to a healthy 53.4 in August. This marks the second month of recovery in Swedbank’s manufacturing PMI data and also constitutes the strongest level of expansion on a monthly basis for the first time since June 2018.

This report, coupled with the ongoing bearish sentiment on the US Dollar, allowed the Swedish Krona to gain against the greenback, sending the pair to two-year lows. The USDSEK is now trading at 8.64649, after bouncing off lows of 8.60837 last week.

Technical Outlook for USDSEK

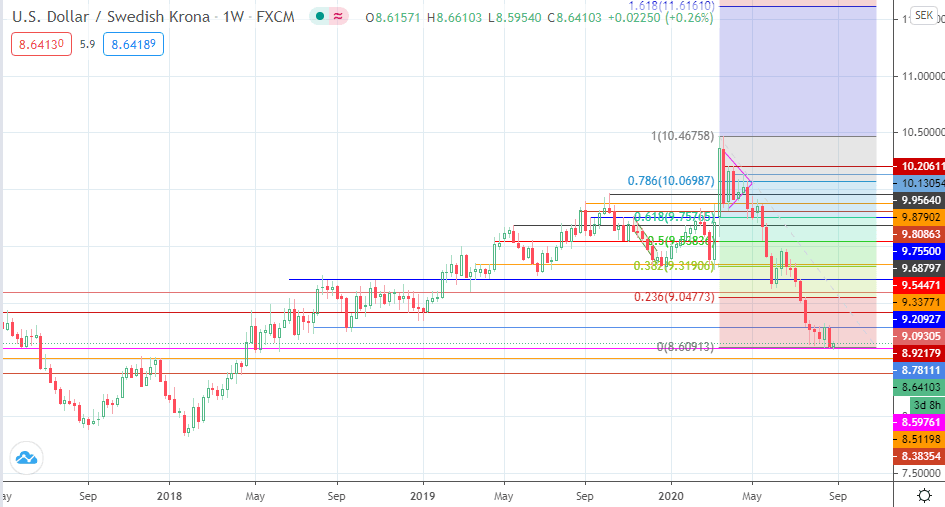

The pair is now trading in a 5-week range, which has 8.78111 as the ceiling and 8.59761 as the floor. A breakdown of the 8.59761 support line could follow further weakness in the greenback, allowing the USDSEK to target the 8.51198 support, with 8.38354 lining up as an additional support barrier if price continues to go south.

On the flip side, a short term retracement move could allow the USDSEK to push up towards the 8.78111 resistance, with additional targets to the north seen at 8.92179 and 9.09305. The Fibonacci retracement levels traced from the swing high of 16 March to the swing low of 24 August on the weekly chart show the 38.2% and 50% retracement levels at 9.31906 and 9.53836 respectively to be key price levels to the north, as they are close to established resistance levels at 9.33771 and 9.54471, respectively.

Don’t miss a beat! Follow us on Telegram and Twitter.

USDSEK Weekly Chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Eno on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.