The Turkish lira slumped to the lowest level on record as investors waited for the upcoming CBRT interest rate decision. The USD/TRY pair rose to an all-time high of 10.2190 while the GBP/TRY and EUR/TRY soared to 13.74 and 11.62.

CBRT decision

The Central Bank of the Republic of Turkey will start its two-day monetary policy meeting. This meeting will come at a time when the Turkish economy is struggling. Inflation and unemployment rate have surged and there are signs that the situation will worsen.

Therefore, analysts expect that the CBRT will slash interest rates again during the meeting. This is an unorthodox monetary policy that is acting as an experiment for other central banks.

This is simply because most central banks believe that interest rates should rise when there is runaway inflation. Instead, the CBRT has slashed interest rates three times and hinted that it will cut more. Now, analysts expect that it will lower rates to about 15%.

So, how will the Turkish lira react to this statement?

USD/TRY forecast

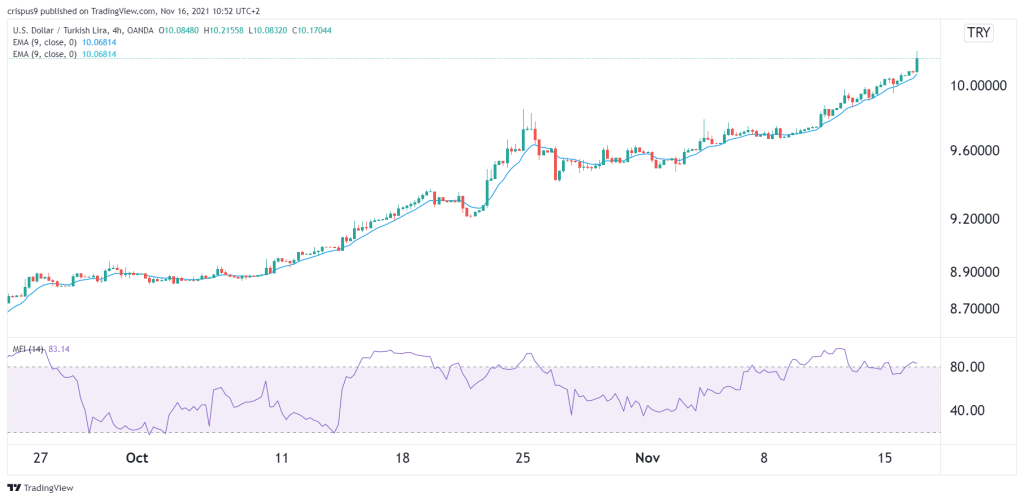

On the four-hour chart, we see that the USD/TRY pair has been in a strong bullish trend lately. The pair managed to cross the key resistance level at 10.0 this week. This means that the Turkish lira is still becoming worthless. As a result, it has jumped above all moving averages while the Money Flow Index (MFI) has jumped to the overbought level.

Therefore, in the long term, the lira will keep rising as long as the Turkish lira maintains a dovish tone. However, in the near term, there is a likelihood of a small pullback as investors sell the news.