The USD/SEK is up 1.49% this Thursday, and this uptick keeps the pair on course for yet another higher weekly close. The pair touched off the 10.83774 peak this Thursday, marking its highest price level in 2022 before retreating slightly. This move came as the US Dollar gathered strength ahead of tomorrow’s big jobs report.

In data released this Thursday, the US ISM Manufacturing PMI came in at 52.8, leaving this metric that measures business conditions around the US manufacturing sector unchanged. A poll of economists had shown a consensus that the index would show a contraction from the previous month’s value of 52.8 to 52.1.

The Riksbank’s next monetary policy meeting is on 19 September, two days before the Fed meets. The current interest rate in Sweden remains at 0%, which has also served to provide the interest rate divergence that has propelled the USD/SEK to its current 2022 highs.

With a lack of high-impact fundamentals from Sweden this week, the USD/SEK has been left to the unopposed action of USD fundamentals, which remain bullish heading into Friday’s Non-Farm Payroll report. Economists are predicting a slowing of wage inflation, a contraction in the labour market for August, and a static unemployment rate.

USD/SEK Forecast

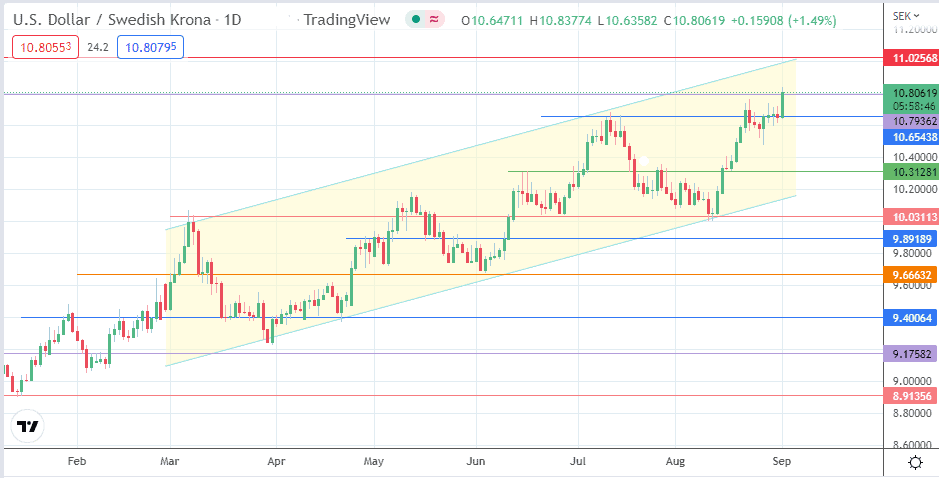

The intraday uptick has met resistance at the 10.79362 price barrier. A break of this price mark targets the 11.02568 barrier, the site of a prior double top of 8 June/9 July 2001. The 5 July 2001 peak at 11.0640 remains the all-time high and the price to beat if the pair is to break new records.

On the flip side, rejection at 10.79362 leads to a retreat that targets the intraday support at 10.65438 (14 July 2022 high). If the bulls fail to defend this support, the corrective decline continues, targeting 10.31281 after a brief stopover at 10.46820 (11 July and 26 August lows). Additional targets to the south reside at 10.03113 (27 June and 10 August lows) and 9.89189. Attainment of the latter would require a breakdown of the channel’s trendline to become a viable harvest point for the bears.

USD/SEK: Daily Chart