The USD/RUB has been in a strong bullish trend in the past few days as the Bank of Russia continues to run out of options. As a result, the pair jumped to an all-time high of 154 on Monday, which was substantially higher than this year’s low of 74. This trend makes the Russian ruble the worst-performing currency globally this year.

The USD/RUB, EUR/RUB, and GBP/RUB have all surged following the Russian invasion of Ukraine. As a result, the country has been isolated from the outside world. Indeed, analysis shows that it is now the most sanctioned country globally. Its sanctions are more than those of countries like Iran, North Korea and Venezuela.

The sanctions have been far and wide. For example, some of the biggest Russian oligarchs have been sanctioned and can no longer travel to western countries. Similarly, the private sector has embraced its own restrictions, with some like BP and Shell paying a heavy price. Other firms that have exited Russia are EY, PwC, Netflix, and Visa.

At the same time, it seems like the Bank of Russia has minimal options to save the Russian ruble. Before the invasion, the bank had over $630 billion in cash that it could have used to save the ruble. Now, it has half that since western countries have sanctioned the bank. The Russian stock market is expected to crash when it reopens.

USD/RUB forecast

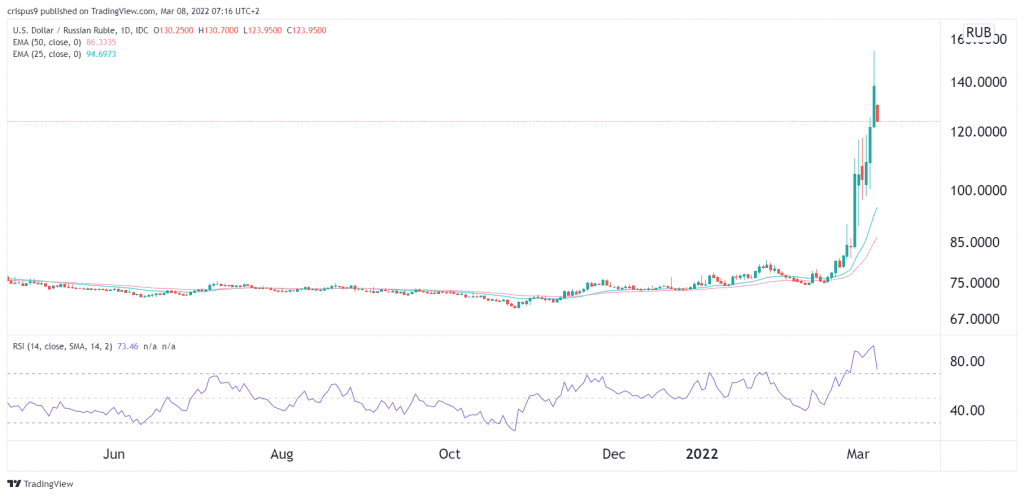

The daily chart shows that the USD/RUB has been in a remarkable bullish trend in the past few days. On Tuesday, the pair retreated sharply after Germany expressed its opposition for banning Russian oil and gas because of how it relies on them. But the country has also hinted that it will slash its Russian imports by a third in the coming months. Russia has also threatened to close NordStream 1.

The USDRUB pair is trading at 123, which is lower than this week’s high of 154. It remains above the 25-day and 50-day moving averages while the RSI is at an overbought level. The path of the least resistance for the pair is in the upside. If this happens, it means that the pair will retest its weekly high at 154. A drop below 100 will invalidate the bullish view.