The USD/NOK is surging strongly this Friday after US employment data blew the market’s expectations out of the water. Most of the gains have come in the last thirty minutes post-NFP. According to data released by the US Department of Labor, the US economy added 528K public sector jobs (ex. agriculture jobs) in July 2022 (versus 250K consensus), which trumped the previous number of 398K (revised upward).

In addition, the unemployment rate fell from 3.6% to 3.5%, beating the predictions of economists who had forecast that the unemployment rate would stay static. The better-than-expected outcome of the latest in the Non-Farm Payrolls report series has USD bulls pumping their fists.

This is not only because the report is excellent for the greenback, but it also provides the Federal Reserve with a lot of leeways to continue the aggressive monetary policy tightening. Also supporting this outlook, which mirrors recent comments from St. Louis Fed President James Bullard, is the ongoing wage inflation. Average Hourly Earnings rose from 0.4% in June to 0.5% in July, beating market expectations of cooling to 0.3%.

This week’s fourth day of sharp declines in crude oil prices means that the Norwegian Krone, the counter-currency in the USD/NOK pairing, looks set to remain under pressure heading into the new week. The commodity-linked Krone has seen its recent gains against the greenback halted after OPEC raised its production output despite weaker demand for the product. The USD/NOK is currently up 1.11%.

USD/NOK Forecast

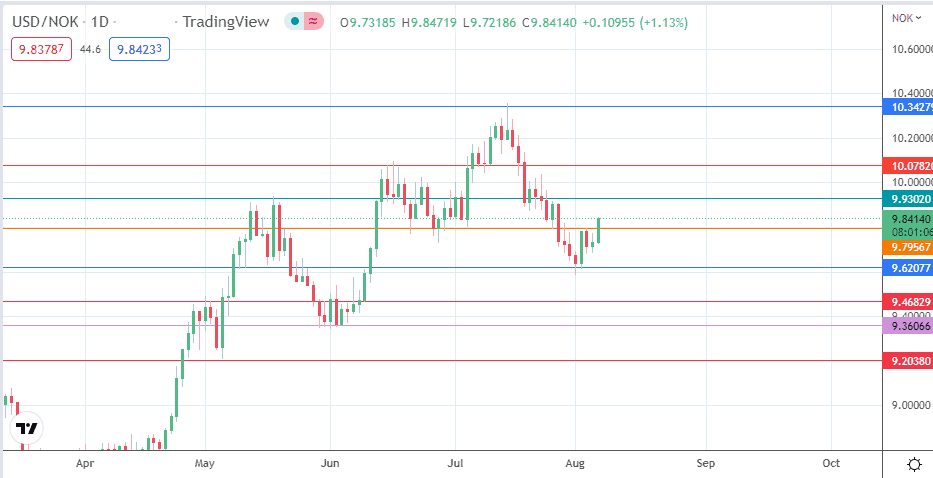

The surge has violated the 9.79567 resistance, and a 3% closing penetration confirms the break of this barrier. This allows the pair to resume the uptrend move following the recent correction, targeting 9.93020 (18 May high) and the 10.07820 upside barrier formed by the previous high of 15 June.

Only a decline below the 9.62077 support causes a resumption of the corrective move from the 14 July peak. This move targets 9.46829 (3 May high, 9 June low) and 9.36066 as the immediate downside targets.

USD/NOK Daily Chart