The USD/MXN is trading mildly lower after losing initial modest gains on the day. The downside sentiment on the pair follows the Mexico Central Bank’s decision to keep its key interest rate unchanged at 7.75%. This move follows the 24 June record interest rate hike by 75 bps that took the country’s interest rates to current levels as the apex bank tries to control growing inflation.

The decision led to a 1.59% gain in the Mexican Peso against the US Dollar, reversing most of Tuesday’s gains in the USD/MXN pair. However, the Peso will face a test of its recent strength after crude oil prices tanked overnight on a rise in US crude oil inventories and an additional increase in production quota by the OPEC + alliance. The Mexican Peso has a direct correlation with the price of crude oil.

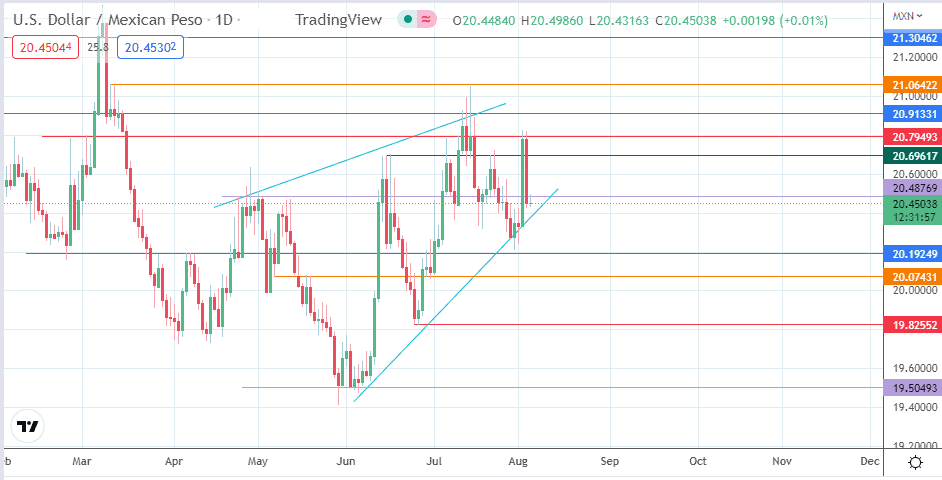

The USD/MXN continues to trade within the rising wedge pattern. The bears need to augment the rejection move seen this morning to initiate a new test of the pattern’s lower border to complete the breakdown and a further downside move. This move will face headwinds if tomorrow’s Non-Farm Payrolls report is USD +ve and next week’s US consumer price index report shows red-hot inflationary trends.

USD/MXN Forecast

The rising wedge on the daily chart remains intact following yesterday’s bounce off the lower edge of this pattern on the back of USD strength. This bounce met rejection at the 20.79493 resistance (2 March and 11 July highs), and the pullback move has violated the support levels at 20.69617 (15 June and 21 July highs) and 20.48769 (25 April/3 May highs and 7/21 July lows). The active daily candle has attempted a return move that has met rejection at the recently violated support, now acting as resistance in role reversal.

The bears would be hoping to seize on the rejection and force a breakdown of the wedge, targeting 20.19249 (8 April and 29 June highs) and 20.07431 (6 May and 30 June lows). Attainment of the measured move comes if the price action is driven to the 2/3 June low at 19.50493. This leaves the 19.82552 support level (24 June low) as the intervening pivot before the measured move is completed.

USD/MXN: Daily Chart