The USDJPY pair is currently trading at 106.61, up 0.2% today on the back of relatively hawkish comments from FOMC members George and Harker yesterday. Furthermore, the FOMC minutes for the July 31 meeting revealed that the FOMC did not plan to carry out more rate cuts in 2019.

Patrick Harker, the President of the Philadelphia Federal Reserve Bank Harker and his Kansas counterpart Esther George argued in their comments that further stimulus was unnecessary and that there really was no need to cut rates below current levels. Esther George had dissented to the rate cut in the FOMC meeting in July.

The Outlook for the USDJPY for Today

Later today, several members of the FOMC will be providing side interviews at the Jackson Hole symposium. The key statement will be made by Jerome Powell at 2pm GMT. The FOMC minutes has clouded the scenario regarding interest rates in the US, and traders will be on the lookout for key pointers from Powell’s speech on what the Fed is thinking at this time, now that many are pricing in further rate cuts before 2019 is over. Furthermore, it will be interesting to note how the Fed intends to respond to the poor IHS Markits Manufacturing and Services PMI data released yesterday, which is showing business activity contraction in the US.

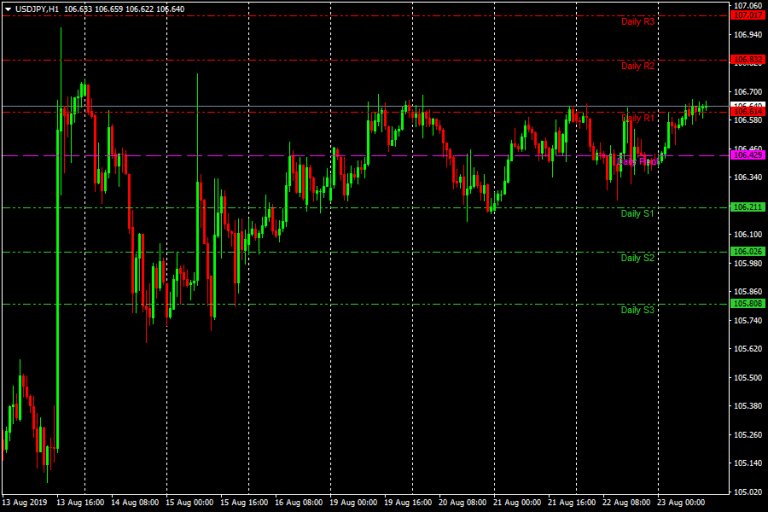

The USDJPY is presently trading at the R1 pivot where it has found resistance. Expect some great volatility once Fed Chair Powell’s speech kicks off.

Don’t miss a beat! Follow us on Telegram and Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.

Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.