The USD/CNY price dropped sharply on Wednesday and then pared back some of those losses on Thursday morning. It dropped to the important support of 6.7227, which was the lowest point since July 14th of this year. It then rebounded to 6.7400 as investors continued to focus on the latest US and China consumer inflation data.

US and China tensions

The USD to CNY exchange rate rose slightly as investors focused on the ongoing tensions between China and the United States. These tensions escalated after Nancy Pelosi visited Taiwan. China has always wanted to have Taiwan back. Therefore, the visit means that China will likely accelerate its planning for the eventual attack of the island.

The USD/CNY price also reacted to the latest China and US consumer inflation numbers that were published on Wednesday. Data published by the Chinese statistics agency revealed that the headline China consumer price index (CPI) rose from -0.2% in June to 0.5% in July. This translated to a year-on-year increase of 2.7%, which was slightly lower than the median estimate of 2.9%.

Meanwhile, in the US, data by the statistics agency showed that inflation dropped sharply in July. The headline consumer inflation data declined from 1.3% o 0.0%. This led to a year-on-year decline from 9.1% to 8.5%. Core inflation, which excludes the volatile food and energy prices, remained unchanged at 5.9%.

USD/CNY price forecast

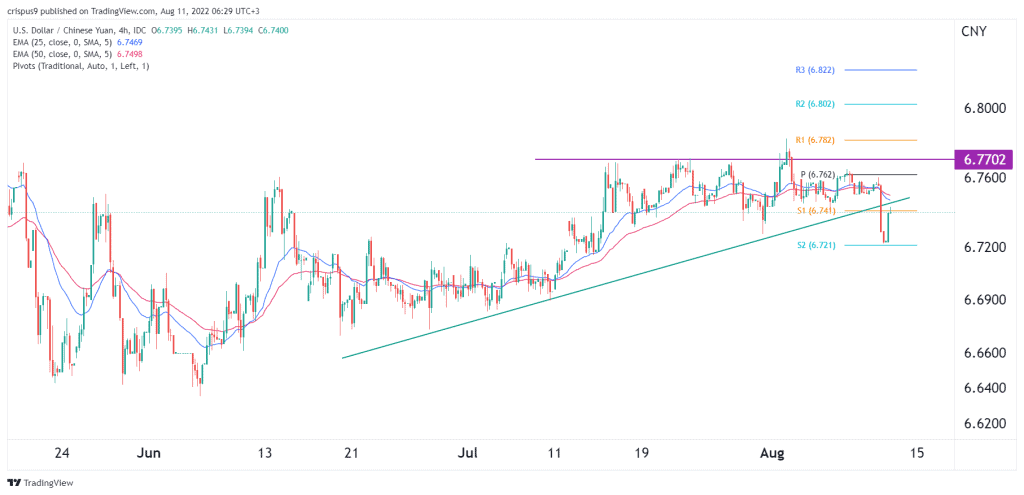

The USD/CNY pair has been moving sideways in the past few weeks. It rose and found a strong resistance at 6.7820, which was the highest point since May this year. The pair then formed what looks like a head and shoulders pattern, which is usually a bearish sign. It then moved slightly below the 25-day and 50-day moving averages.

Now, it has formed a break and retest pattern by touching the ascending trendline shown in green. Therefore, there is a possibility that the USD to CNY exchange rate will resume the downward trend and retest the second support of the standard pivot point at 6.7200. A move above the resistance at 6.7500 will invalidate the bearish view.