Wall Street has made a bullish start to the week, as markets received a boost from expectations that major central banks across the world would set off a new round of stimulus to stave off global recession. The rally is being led by tech stocks such as Apple, which have been boosted by the delay in the Huawei ban by 90 days as well as a key interest rate reform by the People’s Bank of China (PBOC) which would see businesses borrow at lower costs. The German Finance Minister had earlier in the day, hinted at his country’s readiness to spend as much as 50 billion Euros to prevent an economic downturn.

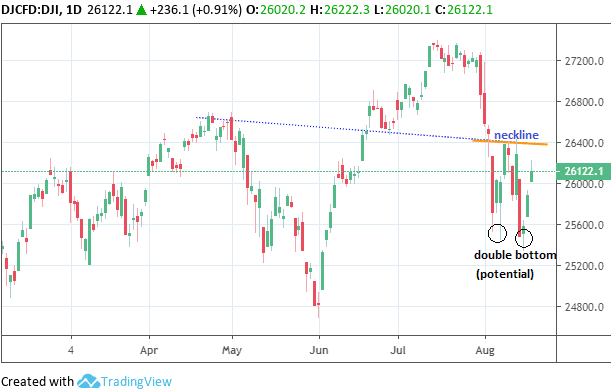

The Dow Jones Industrial Average is presently trading at 26,150, a few points of the day’s highs. A look at the daily chart for the Dow Jones Industrial Average index future points to a potential double bottom formation, right off the 38.2% Fibonacci retracement level of a trace from the swing low of the weekly candle of December 16-23, 2018 to the swing high of the week ended July 21, 2019.

The price action needs to break the neckline level at 26,400 with at least a 3% penetration for the double bottom to be confirmed. Confirmation of the double bottom could lead to a potential move in the long term to the 27,200 price level. Failure to break the 26,400 price mark would invalidate this position and instead point towards a test of 26,206 and 26,000.Don’t miss a beat! Follow us on Telegram and Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.

Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.