The Swiss Franc has traditionally been known as a safe haven currency, and is usually a focus for traders when trading USD-related news such as the FOMC decisions of yesterday. This was why the USDCHF and USDJPY had very strong responses among the USD pairs yesterday. The focus of this piece is the possible technical plays for the USDCHF, as this pair continues to remain relevant after yesterday’s FOMC decision and more so as the Non-farm Payrolls report will be released tomorrow.

This afternoon at 2pm UTC, the ISM Manufacturing PMI figure from the US was released. The figure was slightly disappointing, as the result came in at 51.2, which was slightly lower than the 52.0 that the market was expecting. The USDCHF had a muted response to this news release, with only a minor pullback from the highs of July. USDCHF is presently trading at 0.99452.

Technical Plays for USDCHF

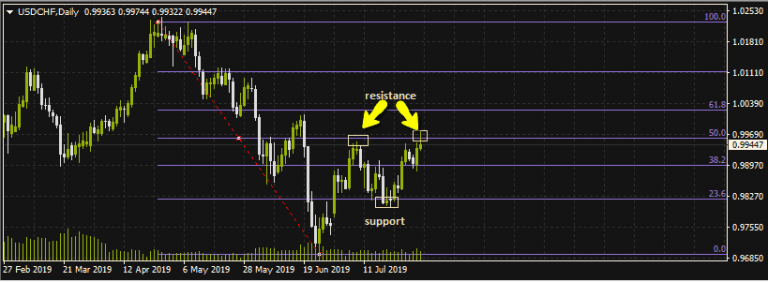

A Fibonacci retracement line traced from the swing high of April 19 to the swing low of June 26 reveals that July’s highs (including the gains posted yesterday after the FOMC decision) are a resistance level which coincides with the 50% retracement line. Presently, the near term resistance is the 50% retracement at 0.99543, with immediate support seen at the 38.2% retracement level of 0.9898.

If the NFP result surprises to the upside, this may cause a break of the current resistance level, thus opening the door for a test of the next resistance seen at the 61.8% Fibonacci retracement level (1.00274). This is where the highs of June 2019 are located.

On the flip side, a worse-than-expected NFP result may force the currency pair downwards, which will see the USDCHF testing the 0.9898 and 0.98188 price areas respectively.Don’t miss a beat! Follow us on Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.

Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.