The US Dollar index trading 0.05 percent lower at 96.17 after mixed macroeconomic date released earlier. The Chicago Purchasing Managers’ Index came at 49.7 below markets expectations of 53.1 for June. The University of Michigan’s Consumer Confidence Index came in at 98.2 for June and beating analyst’s forecasts of 98. The Core Personal Consumption Expenditure – Price Index, year over year, matched markets expectations at 1.6 percent for May while the Personal Income month over month, came in at 0.5%, beating forecasts of 0.3% for May.

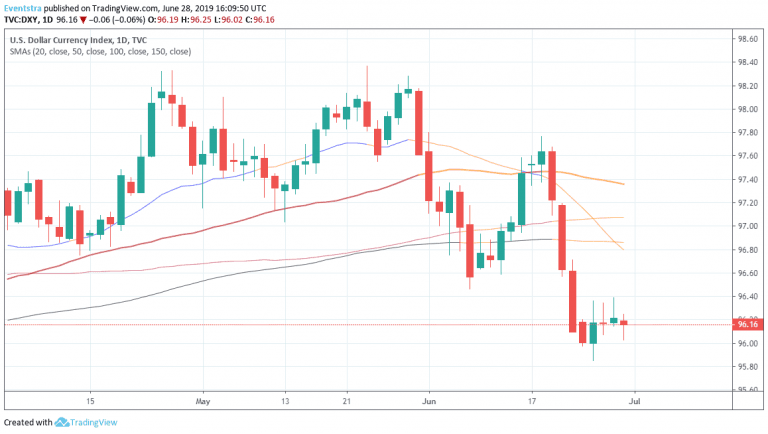

DXY managed to rebound from the weekly low at 95.85 and currently makes an attempt to close above the 50 and 100 hourly moving averages. The bias is neutral as traders watching the discussions in Osaka. Only a sustained move above 96.79 the 20 day moving average will signal the return of buyers in the index. On the downside immediate support stands at 96 psychological mark while more bids will emerge at 95.85 weekly low.Don’t miss a beat! Follow us on Twitter.