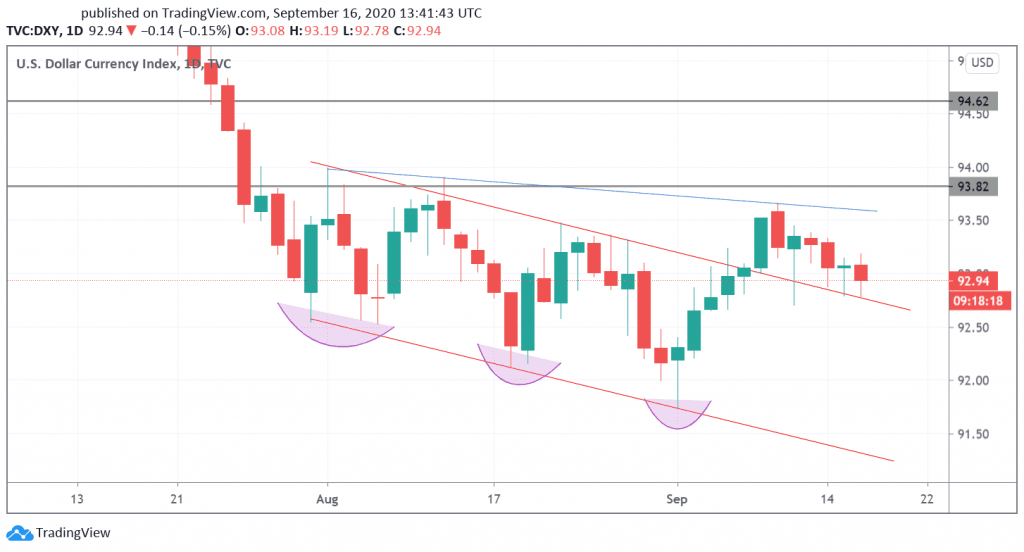

The US Dollar index was lower on the day ahead of the Federal Reserve interest rate decision but the price is still seeing support and could test the resistance of a potential head & shoulders pattern.

Retail sales in the U.S. came in at a disappoint 0.6% gain for August after analysts expected a 1% improvement. There was also a downward revision to July’s 1.2% figure, which was updated to 0.9%. The release also saw a 0% gain for online retailers. Analysts are citing the end of stimulus programs as a cause of the latest slowdown and the numbers could affect GDP expectations for the consumer-centric US economy.

All eyes will now turn to the Federal Reserve interest rate decision. There is not likely to be any Federal Reserve action with rates after some strong data in areas such as manufacturing but the economic projections for the economy will be important.

The OECD today revised their expectations for global GDP but still expected a drop of -4.5% for the global economy this year. They also noted that this was highly dependent on continued stimulus efforts from central banks. The US and euro economies are expected to contract by 3.8% and 7.9%, respectively, and traders will look to the Fed to see if the recent Euro gains were overdone.

US Dollar Technical Outlook

The US Dollar index was lower on the day but the price is holding support around the 93.00 level. The chart shows a head & shoulders-style pattern playing out. This could lead to further gains with a close above 93.50 on the daily chart. The target would 94.62 which was last seen in July. This level provided important support in March. The Investing Cube team is available to assist all levels of traders with a Forex Trading Course or one-to-one coaching.

Don’t miss a beat! Follow us on Telegram and Twitter.

US Dollar Index Daily Chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Kevin on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.