The US Dollar index ending the week just at the highs adding 0.42 percent to 97.45 boosted by robust U.S. economic data. Data released earlier today showed that retail sales rose 0.5% in May and April’s data was revised higher. Core sales also gained 0.5% MoM and Retail Sales Control expanded more than expected 0.5% inter-month. Industrial Production expanded 0.4% MoM in May and Manufacturing Production gained 0.2% from a month earlier, both figures beat economist’s estimates. The only disappointment came from the University of Michigan’s Consumer Confidence Index which fell to 97.9 in June’s preliminary reading from 100 in May and came in slightly worse than the consensus expectation of 98.

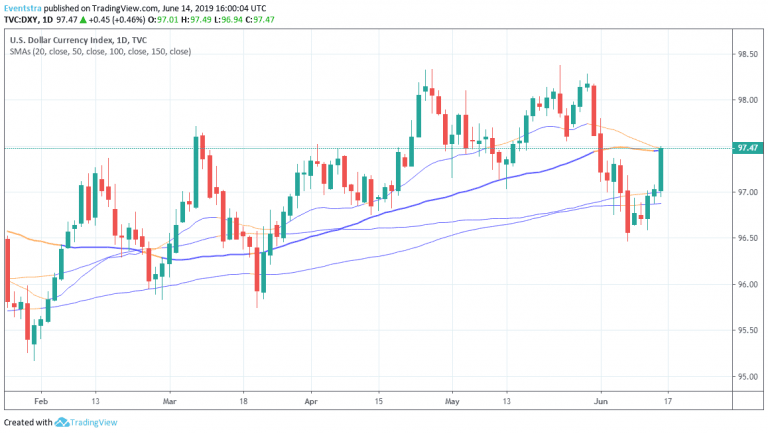

DXY rebounds from previous week low at 96.46 and today during the US session the index managed to breach above the 20 hour moving average and as of writing the price is at the daily high to 97.46. The bulls are in control for the short term as the index started the day from the 100 day moving average and now faces the key resistance at 97.45 where the 50 day moving average crosses. A convincing break above can accelerate the rally up to 98.14 the high from May 31st. On the downside immediate support stands at 97 while more bids will emerge at 96.86 where the 150 day moving average crosses.