The Uniswap price is in a tight range as the cryptocurrency industry reflects on the new Bitcoin Exchange Traded Fund (ETF). The UNI token is trading at 25.92, where it has been in the past few days. This price is about 47% above the lowest level this month.

UNI fundamental analysis

Uniswap is a leading decentralized finance (DEFI) platform that enables people to buy and sell cryptocurrencies. Unlike other popular centralized platforms like Coinbase and Binance, the platform is not under the control of anyone. Most decisions are made by the community members.

Today, Uniswap has become a major part of the DeFi economy. Already, more than 200 DeFi platforms have integrated with the network. It has more than 1.5 million users and the total volume exceeds more than $386 billion.

In the past 24 hours alone, the total volume in the network has been more than $1.42 billion while the total fees in the network was more than $2.44 million. Uniswap has a total value locked (TVL) of more than $4.9 billion. At its peak, it had a TVL of more than $10 billion.

The Uniswap price popped sharply in September after China banned all foreign companies from offering their services to citizens. The price jumped as investors priced in more demand for Uniswap since it accepts customers of all countries, including China.

Uniswap price prediction

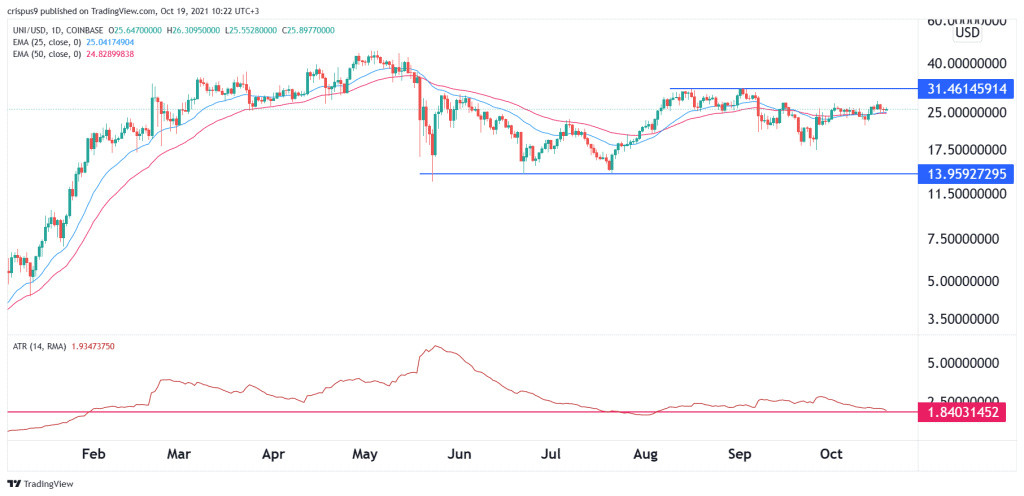

The daily chart shows that the UNI price formed a major resistance level at $31.46 in August and September. It then declined sharply and moved below the chin of the double-top pattern at around $24.97. Then, the price declined to a multi-month low of about $17.66.

Today, the coin is along the 25-day and 50-day moving averages. It has also formed a small inverted head and shoulders pattern, which is usually a bullish signal. At the same time, the Average True Range (ATR) indicator has dropped to the lowest level since August.

Therefore, the coin will likely have a major bullish break-out in the near term. This view will be confirmed if the price manages to move above the key resistance at $31.46. On the flip side, a drop below the head level at $17.66 will invalidate this view.