The Unilever share price is up 0.3% this Friday, but the upside remains capped as the company continues to see headlines from its attempted Isreal pullout for all the wrong reasons. It has emerged that the parent company Unilever has frozen the July salaries of the directors of its Ben & Jerry’s Israeli subsidiary.

Recall that Unilever closed the sale of its ice cream business in Isreal to a local licensee named Avi Zinger on 29 June. Ben & Jerry’s sued Unilever, citing the lack of brand protection that the sale would cause. Attempts to resolve the issue through arbitration have failed to yield any positive results. The lawsuit in a US District Court continues.

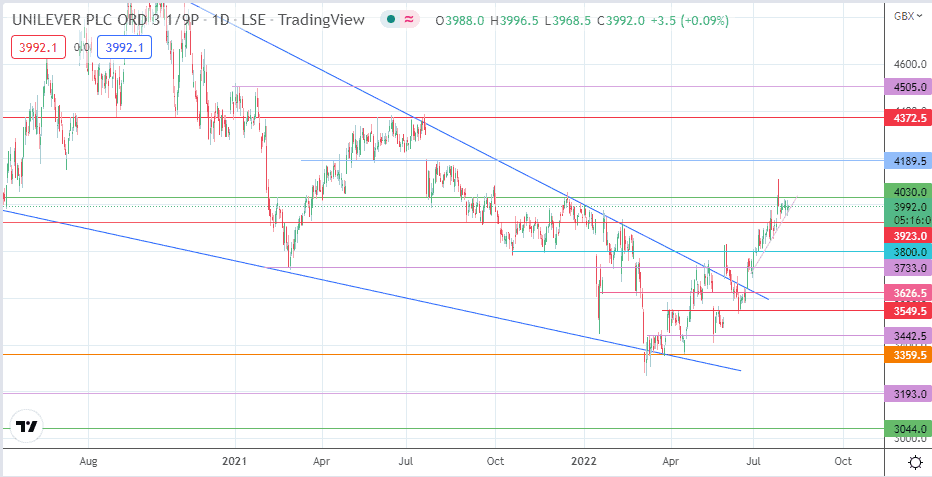

The situation means that the Unilever share price remains capped below the 4030.0 resistance mark following a brief correction that followed its upside run after the break of the wedge pattern.

The bull run was fuelled by the increase in the company’s revenue in the first half of 2022 after reporting an 8.1% sales growth that higher prices have fueled. Revenue stood at $30 billion in H1 2022, a 14.9% increase over the same period in 2021. Second quarter revenue climbed 17.5% year-on-year to more than $16 billion.

Unilever Share Price Forecast

The ascending trendline is holding up the intraday uptick. A bounce from here that breaks the 4030.0 resistance clears the path toward the 4189.5 resistance. However, the move must take out the 27 July high at 4109.5. A further ascent beyond 4189.5 continues the measured move from breaking the large falling wedge pattern. This move is expected to find completion at 4372.5, with the 4300.0 psychological price mark (21 July 2021 low) being the only pitstop along the way.

On the other hand, a breakdown of the ascending trendline targets the 3923.0 support as the initial target. If the correction continues below this pivot, we could see the 38000.0 psychological price mark as the next downside target. Additional harvest points available on a further price deterioration

include 3733.0 (6 June high) and 3626.5 (21 January and 18 May lows. There is also the potential for the wedge’s broken upper border to become available as new support somewhere around the 3549.5 support, where the 17 June low is located.

Unilever: Daily Chart