The Unilever share price has been on a steady decline since October 2020, losing over 20 percent of its value. Unilever also lost 11 percent of its value in the calendar year 2021, and today its shares are trading at 3820 GBx.

Unilever Earnings Overview

Unilever had a fantastic 2021 based on underlying sales growth of 4.5 percent, with 2.9 percent price and 1.6 percent volume, which was the fastest in nine years. The company also recorded an impressive 3.4 percent growth in turnover with a positive impact from acquisitions and the negative impact from currency.

Among the decisions made in 2021 that will likely impact Unilever’s prices in 2021 is the sale of their Tea business for €4.5 billion ($5.09 billion). This sale is expected to be completed in the second half of 2022.

In 2021, the company also announced that it had successfully completed €3 billion ($3.4 billion) share buyback. The share buyback program is also expected to be effective in the 2022-2023 financial year when the company plans to buy back shares of almost the same amount in the third quarter. The company also indicated that the dividend growth per share for 2021 was 3 percent.

Unilever Dividends

The latest available dividend payout for Unilever shareholders was

GBP 0.3598 ($0.49), and was paid out for the fourth quarter of 2021. The next dividend payout for Unilever’s ordinary shareholders will be on 22nd March 2022, and investors should expect around the same amount paid in the last quarter of last year.

Unilever Share Price Analysis

Unilever’s share prices have largely been driven by fundamentals for the last two years. At its core, the company specializes in household and personal products. This is reflected in its 2021 underlying growth, which was the fastest in 2021, and the company’s earnings reports.

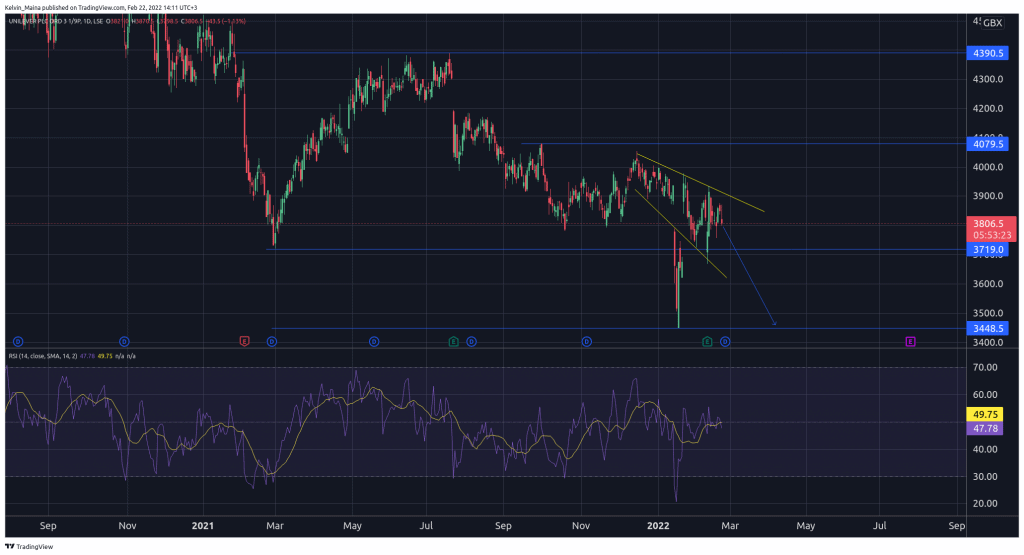

However, technical analysis can also offer insight into what we should expect with Unilever. On January 19, the share prices set a new low of 3448 GBx, a level that has not been breached in 5 years. Although the prices have since jumped to trade at the current prices of 3820 GBx, I expect the prices to drop to the support level of 3448 GBx again this year. This is because, based on the data from last year, when sales were strong but share prices kept going down, there is a possibility that investors are not bullish on the company.

Is Unilever a Good Investment

Unilever remains a good investment for long-term traders. However, based on my fundamental and technical analysis of the company, I still expect the prices to go down before recovering, which may impact short-term traders.

Unilever Daily Chart