The leader of the opposition Labour Party in the UK Jeremy Corbyn has announced plans to stop a no-deal Brexit on Tuesday by preventing UK Prime Minister Boris Johnson from shutting down parliament.

In his words, “we should legislate rapidly to prevent a no-deal Brexit…we will put a vote of no confidence at the appropriate moment.”

Recall that the UK PM had requested Queen Elizabeth II to prorogue Parliament from a period not earlier than 9th September to not later than 12th September. Parliament is then to resume a new session on October 14th with a speech by the Queen. UK PM Johnson’s move has attracted widespread criticism, with some branding the move a “constitutional outrage”.

The British Pound is hinging its bullish hopes on the ability of Labour leader Corbyn to prevent a no-deal Brexit. However, with Boris Johnson aiming to cut out the Parliament from his own pathway which has a no-deal possibility, the road to recovery for the British Pound seems pretty rocky.

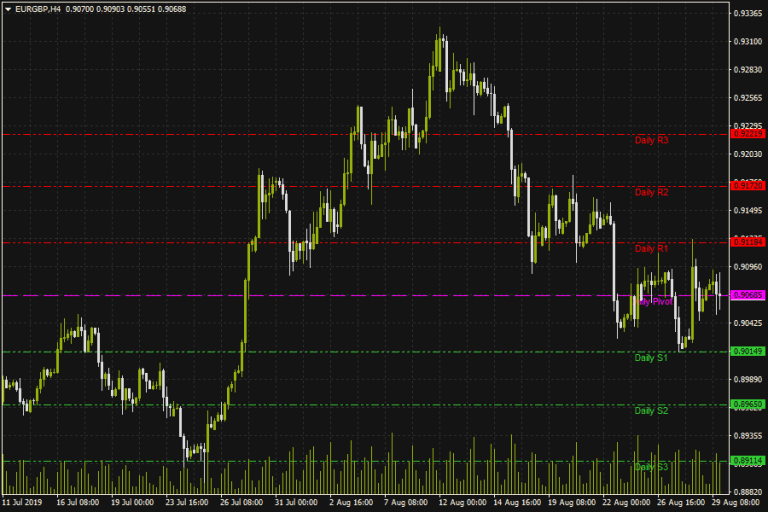

The EURGBP will experience quite some volatility in the lead-up to the final exit of the UK from the EU. The Euro has suffered in its own right as the ECB leadership has indicated that the next meeting will see a number of stimulus steps being implemented.

The pair has been trading in largely range-bound fashion all week and is currently at the 0.9068 price level. Pivot points continue to provide guidance for near-term range trading. Price needs to break above 0.9068 to be able to push up to 0.91184. A break of this level will open the door to 0.9172 and possibly 0.92219. A breakdown of the 0.9068 price level will show the pathway to 0.9014 and 0.8965 below.Don’t miss a beat! Follow us on Telegram and Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.

Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.