Twitter stock (NYSE: TWTR) was sold hard on Wednesday after the social media giants latest trading updates revealed modest user growth. Whilst Twitter’s third-quarter update showed total monetizable daily users (mDAUs) increased 13% to 211 million, the U.S. user base grew by just 1m million over the three months.

As a result, KeyBanc Capital Markets lowered its 12-month price target from $81 to $70. Analysts at the bank warned, “Twitter needs to materially reaccelerate U.S. and international growth“. Furthermore, other analysts predict Apple’s new privacy changes could be a headwind for Twitter as we advance. As a result, the stock is 20% lower in the last week and 40% below the February high. Unfortunately for shareholders, the technicals are also rapidly deteriorating, potentially triggering more selling in the days and weeks ahead.

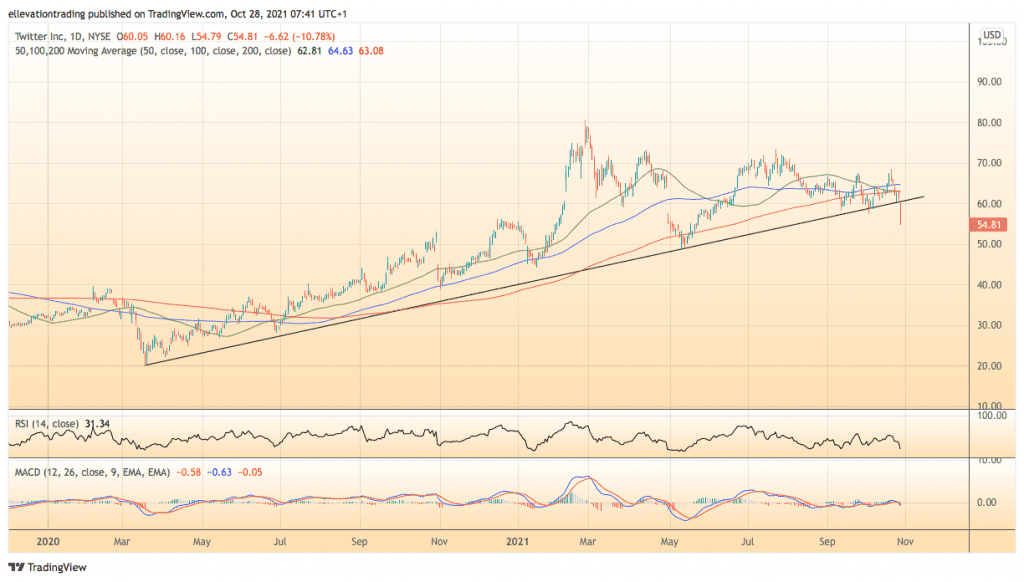

TWTR Price Forecast

The daily chart shows the share price has broken trend support (now resistance ) at $60. Furthermore, the price is below the 50, 100, and 200-day moving averages. And the 50-DMA at $62.81 has completed a bearish death cross and below the 200 DMA at $63.08. Additionally, the Relative Strength Index is deep in bearish territory and suggests more downside to follow. However, at 31.34, the indicator is close to oversold. Nonetheless, it still has room to move lower.

Considering the above technicals, the path of least resistance is south. A logical downside target is the May lows around $49.00. At the same time, a steeper decline could target the February 2020 high of $39.00. As long as Twitter stock is below the rising trendline, the bearish outlook should prevail. However, a close above $60.00 invalidates this thesis.

Twitter Stock Price Chart (Daily)

For more market insights, follow Elliott on Twitter.