US President Donald Trump hit his Twitter handle once more to rap the Fed for not admitting that they made a mistake in ramping up interest rates “too fast”. In the tweet’s opening remarks, Trump laid the blame on the Fed and not on the Chinese, tweeting:

“Three more Central Banks cut rates.” Our problem is not China – We are stronger than ever, money is pouring into the U.S. while China is losing companies by the thousands to other countries, and their currency is under siege – Our problem is a Federal Reserve that is too….proud to admit their mistake of acting too fast and tightening too much (and that I was right!). They must cut Rates bigger and faster, and stop their ridiculous quantitative tightening NOW. Yield curve is at too wide a margin, and no inflation!”

Trump tweeted once more: “We will win anyway, but it would be much easier if the Fed understood, which they don’t, that we are competing against other countries, all of whom want to do well at our expense!”

These comments continue to create concern among market players on the independence of the US Federal Reserve, especially as Turkey is showing signs of being an example where the central bank is basically doing the bidding of a nation’s president. US lawmakers and indeed, surviving ex-Fed Chairs have repeatedly condemned what they have termed as the “jawboning” of the Fed by President Trump.

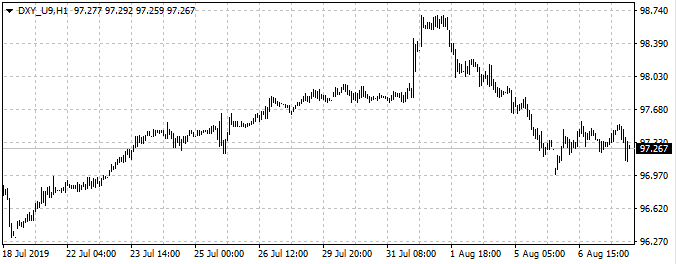

On the back of these comments, interest rate traders on the exchanges of the CME Group have raised the odds of a 50bps September rate cut by the Fed from 15% to 35%, according to data from the FedWatch Tool. The market is giving a 59% probability that rates will be reduced by at least 0.75 bps from the current interval of 2.00-2.25%.Don’t miss a beat! Follow us on Telegram and Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.

Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.