Since shares soared 13% on 4 February after reported private equity interest, it has been downhill for The Hut Group’s share price. Shares had jumped to 135.4p, pushing the company’s valuation to £1.65billion after reports had linked Advent International, Apollo, and Leonard Green & Partners with a potential buyout. However, nothing has come of this reported interest, and shares have tanked heavily in recent weeks.

The company’s woes were worsened by last week’s drop in the FTSE 100, the heaviest since the pandemic-induced drop in March 2020. The tech selloff of late January kicked off the stock’s downward spiral in 2022 after losing 80% of its value in the past year. The company had initially blamed the stock’s steep slide on a coordinated speculative attack from hedge funds.

Then came claims of aggressive discounting on the company’s e-commerce websites, with a report from Telegraph claiming that Dermalogica had restricted supplies in response, a claim that The Hut Group categorically denied.

The Hut Group runs several e-commerce businesses which specialize in personal care products. It is also heavily involved in nutritional supplementation and technology (via its subsidiary company Ingenuity). The Hut Group’s share price is -0.85% as of writing.

The Hut Group Share Price Outlook

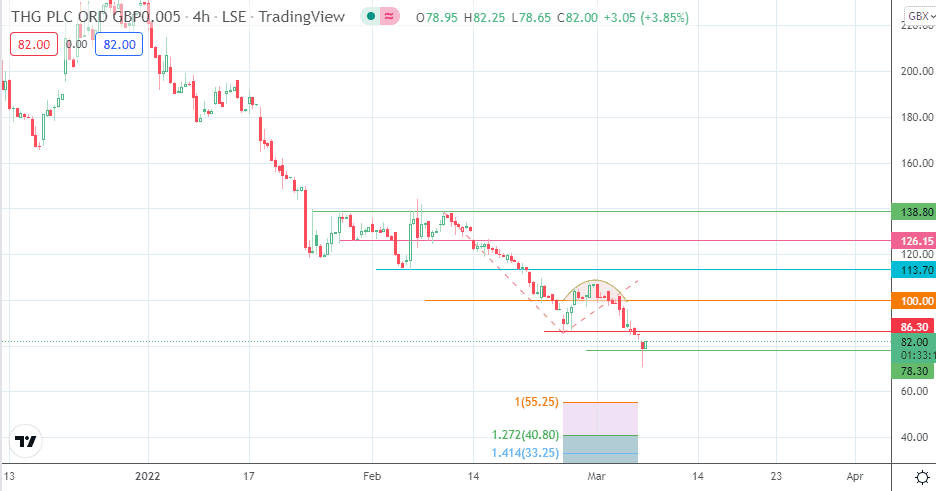

The 4-hour chart reveals that the stock has pared some of the losses on the day, following the formation of a hammer candle on the 78.30 support level. This has opened the door for a potential move towards the 86.30 resistance. Above this level, 100.00 and 113.70 could serve as possible checkpoints to the north.

However, these resistance barriers provide potential rally-sell points. A breakdown of 78.30 is the ultimate target, potentially opening the door for a slide towards 55.25 and 127.2% (100% and 127.2% Fibonacci extension levels). 33.25 (141.1% Fibonacci extension) is an additional target to the south, which only becomes viable on a deeper correction.

The Hut Group: 4-Hour Chart

Follow Eno in Twitter.