Tesco was founded in 1919 by Jack Cohen, the child of Polish immigrants. He was a Jew who started selling groceries considered surplus to the war effort at the East End of London. The company’s branding was seen for the first time in 1924.

Tesco’s 2014 initial public offer raised $25 billion, making it the largest IPO in the world at the time. It also made Jack Ma the richest person in China at that time. Tesco secured a listing on the New York Stock Exchange through this IPO. The company’s sales on Singles Day (November 11 or 11/11), Black Friday, and Cyber Monday shopping festivals have consistently broken sales records.

Tesco Stock News

The latest Tesco stock news speaks of the impact of the Russia-Ukraine conflict on UK shoppers, who are already grappling with 30-year high consumer prices. A new report by UK market researcher NielsenIQ says that the war could produce global food supply disruptions, which along with soaring energy prices, could impede growth in supermarket sales volumes.

The report said that with inflation at UK supermarkets hitting eight-and-a-half-year highs at 2.7%, shopper budgets looked set to be impacted.

The impact is already being felt. Grocery sales at UK supermarkets dropped 3.4% in the four weeks preceding February 26 on a year-on-year basis. Sales from online channels fell 12.5%, slightly higher than the January figure of 13.1%. However, Tesco retained its market share leadership over Sainsbury’s, Asda, and Morrisons, despite year-on-year sales declining 1.5%.

Will Tesco Stock Go Up?

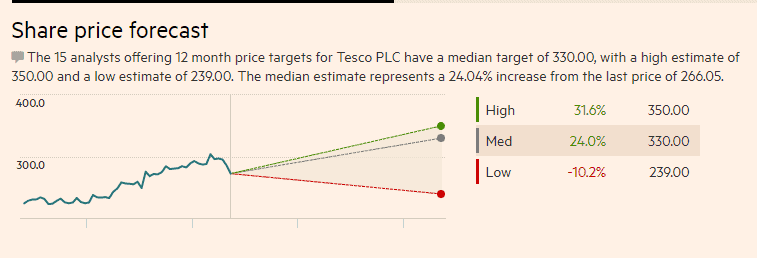

According to the Financial Times, fifteen institutional analysts have set a 12-month median price forecast for Tesco’s share price at 330.00. The high end of the estimate is set at 350.00, while 239.00 was set as the lower limit. The current price of 274.80p as of March 9 2022, allows for a 27.01% increase in the Tesco share price.

The recent market correction boosted the potential for a price increase on the FTSE 100 index following the Russian invasion of Ukraine on February 24. However, this event set off risk-averse sentiment on the index while also souring sentiment on supermarket chains that have global exposure by selling foreign products or sourcing raw materials from foreign countries. For instance, Russian-made vodka is routinely sold in some UK supermarkets. However, the onset of Western sanctions means that such products are being taken off the shelves in several UK supermarket chains. This level of exposure is what investors are currently trying to navigate.

However, the correction has brought the Tesco share price down to levels many investors would find attractive, given the price projections of the institutional analysts. Moreover, there is every indication that the Tesco share price will increase.

Tesco Stock Forecast 2022

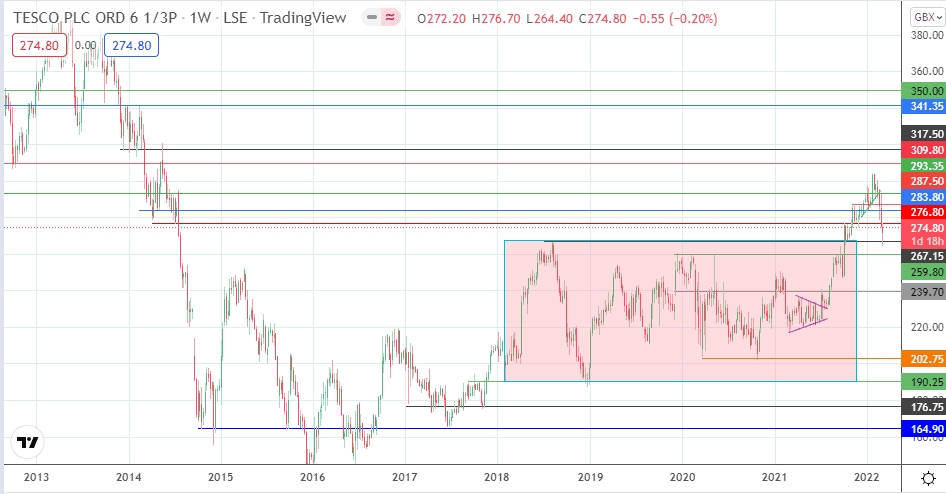

The Tesco stock forecast for 2022 is made off the price picture on the weekly chart. The weekly chart shows that the outlook for the Tesco share price is bullish.

The stock is in an uptrend, having exited the range formed by the 267.15 resistance (ceiling) and the 190.25 support (floor). The corrective pullback of recent weeks in 2022 has tested the upper band of this range at 267.15, with the bulls defending that price mark with an upside bounce. This bounce is currently testing the 276.80 price resistance. If the bulls can uncap this barrier, 283.80 and 293.35 become viable short-term targets. However, the march towards the median price forecast of the 15 institutional analysts begins when the bulls overcome the resistance at 304.15 (January 24, 2022, high), allowing for the approach to sequential targets at 309.80, 317.50, and 341.35 before September 3, 2012, high at 350.00 comes into the picture.

On the flip side, only a breakdown of 267.15 and the May 11, 2020, high at 259.80 will cause the Tesco share price to aim for the lower band of the institutional price targets. So at this time, the Tesco share price would consolidate and would be unlikely to achieve the 12-month median price target set.

Tesco Stock Forecast 2025

The Tesco stock forecast for 2025 is not set in stone. Several factors could determine the ability of Tesco to deliver the performance that will either attract demand and raise its stock price or not.

The Bank of England has just commenced a rate tightening cycle to combat inflation, currently at 30-year highs. How will the BoE action impact prices in retail stores, especially as external geopolitical factors are at work in the market presently?

Will the world see a resurgence of the COVID-19 pandemic, or will other factors change consumers’ shopping habits? How will the emergence of central bank digital currencies impact consumer shopping behaviour? Will Tesco maintain its top status among the “Big Four” supermarket chains? How will all these affect sales and revenue?

Time will have to unfold for these factors to play out. Only then would any Tesco stock forecasts make sense and be more accurate.

Is Tesco a Good Stock to Buy?

Is Tesco a good stock to buy?

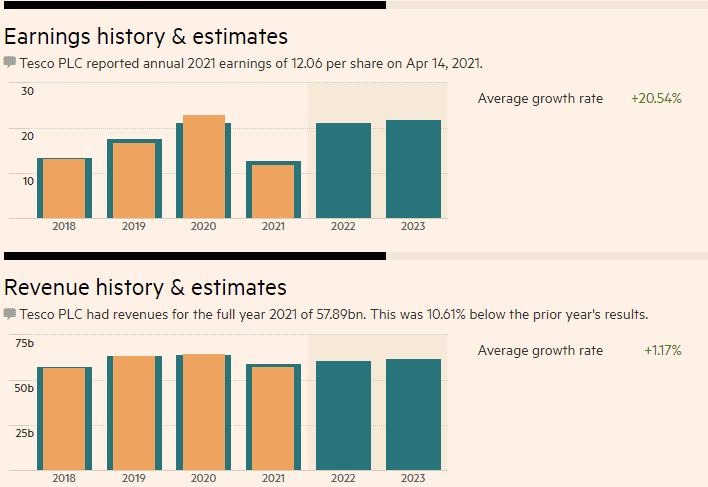

Tesco’s earnings have shown an average growth rate of 20.54% in the period from 2018 to date. Revenues have also increased since 2018, with a slight dip in 2021.

Tesco adapted very well to the new challenges that COVID-19 brought to the UK’s shopping industry, and it is now reaping the benefits. Of course, Tesco’s business revolves around a basic human need: food. But, as the company’s experience in the last two years has shown, shoppers have now adapted to purchasing their groceries in-person or online.

The UK’s biggest supermarket chain is a business for the present and the future, and therefore Tesco is a good stock to buy in the medium-term and long-term.

Summary

Tesco stock forecasts are bullish and institutional analysts have recommended a BUY for the stock. The best time to buy a stock in an uptrend is to buy the dip. Tesco is in an uptrend, the price has dipped and there is room for upside as per the 12-month price target.

Tesco: Weekly Chart