The Tesco share price is facing another day of selling after UK retail market researcher Kantar said that consumer prices were rising at their fastest rate since 2013, pandemic-induced costs excluded. Kantar said that UK grocery inflation was at 4.3%, a 9-year high. The firm also warned of headwinds from supply chain constraints and the ongoing conflict between Russia and Ukraine.

Consumer price inflation is currently at 5.5%, representing 30-year highs. This could peak at 7.25% in April 2022, according to the Bank of England (BoE) which is already implementing a rate-hiking cycle. Experts believe that the ongoing war between Russia and Ukraine and the hikes in energy prices could push consumer prices beyond the BoE’s target. Kantar says that sales of take-home groceries dropped 3.7% in the 12 weeks preceding 20 February as the price hikes pinched consumers. Consequently, the Tesco share price witnessed a third day of selling in a row, losing its earlier gains on the day to fall 0.5% at writing.

Tesco Share Price Outlook

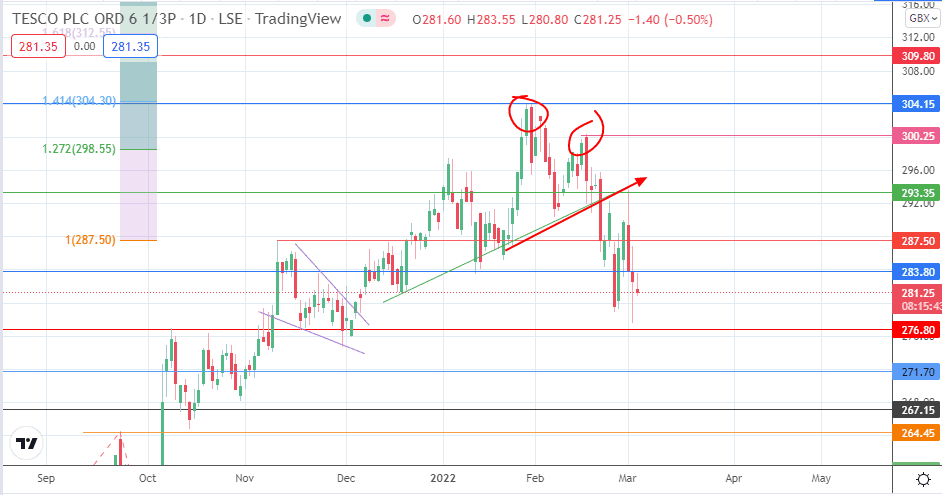

The Tesco share price picture shows that the breakdown of the neckline (an extension of the ascending trendline) completed the double top above the 276.80 support. A renewed run to the north was rejected at the trendline’s extension, precipitating the drop to the current price levels. Following the bounce of Wednesday, bulls failed to create enough momentum, leading to a rejection at the 283.80 resistance. The renewed selling that has followed this rejection is now targeting 276.80. If this support fails, 271.70 becomes the new target, leaving 267.15 in the periphery of the price picture.

On the flip side, a recovery towards 287.50 must be preceded by a break of 283.80. Above this level, 293.35 and 300.25 form the additional price targets. Attainment of the latter has to follow a break of the resistance formed by the ascending trendline. A continuation of the advance would see the higher peak in the double top at 304.15 enter the picture as a new upside target.

Tesco: Daily Chart

Follow Eno on Twitter.