The Taylor Wimpey share price has jumped in the past six consecutive days. The TW stock is trading at 175p, which is the highest it has been since September 28. It has risen by more than 20% above the lowest level on October 28th. This performance has been in par with other homebuilders like Persimmon and Barratt Development.

Taylor Wimpey is one of the biggest homebuilders in the UK. The company made headlines after it was forced to drop a lucrative ground rent charges by the CMA. The deal meant that people who bought leasehold homes from the company would see their ground rent charges double every ten years.

These charges have left many homebuyers struggling to sell or mortgage their homes. In a statement, the company said that it will voluntarily remove those terms from the contracts. It is still unclear how much money the company will lose by terminating the deal. Still, it seems like investors are excited that the investigation by CMA is now behind it.

Focus now shifts to the coming year. Analysts expect that the UK housing market will struggle in 2022. Besides, interest rates have started rising and home prices are at a record high. After the robust growth in 2021, there is a likelihood that the industry will struggle in the coming year.

Taylor Wimpey share price forecast

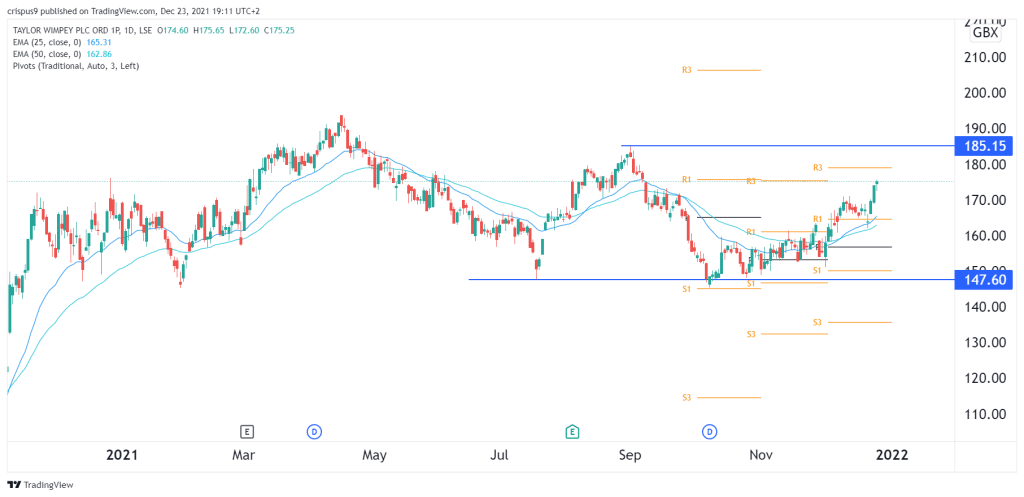

The daily chart below shows that the TW share price has been in a strong bullish trend in the past few weeks. The stock has managed to move above the 25-day and 50-day moving averages (MA). It has also managed to move above the first and second resistance points of the standard pivot points. The Relative Strength Index (RSI) and MACD have also kept rising.

Therefore, there is a likelihood that the Taylor Wimpey share price will keep rising as bulls target the third resistance at 180p and possibly 200p. This view will be invalidated if the price drops below the key support at 170p.