The Taylor Wimpey share price is under pressure this Tuesday as the markets resume trading following the conclusion of the Easter holidays. Again, the stock felt pressure as the market digests the financial impact its recent pledge on fire safety and cladding repairs will have on the company.

The company signed the UK Fire Safety Pledge about two weeks ago and committed to raising the ceiling on its spending to support the costs of repairing damaged cladding in buildings it had constructed from 1992 to date. The total costs of the commitment, including fire safety remediation costs, are in the region of 245 million pounds. This figure represents an additional 80 million pounds provision the company has made.

Various UK homebuilders signed up to the pledges after reports that the UK government was demanding that homebuilders contribute to a four-billion-pound cladding remediation support fund. The Grenfell Tower Fire of 2017, which killed 72 people, sparked the cladding and fire safety remediations that are now in the works.

The Taylor Wimpey share price started the day lower but has clawed back from these losses and is trading 0.14% higher. However, as the stock’s technical outlook shows, this ascent looks set to face a stiff challenge at a key resistance.

Taylor Wimpey Share Price Outlook

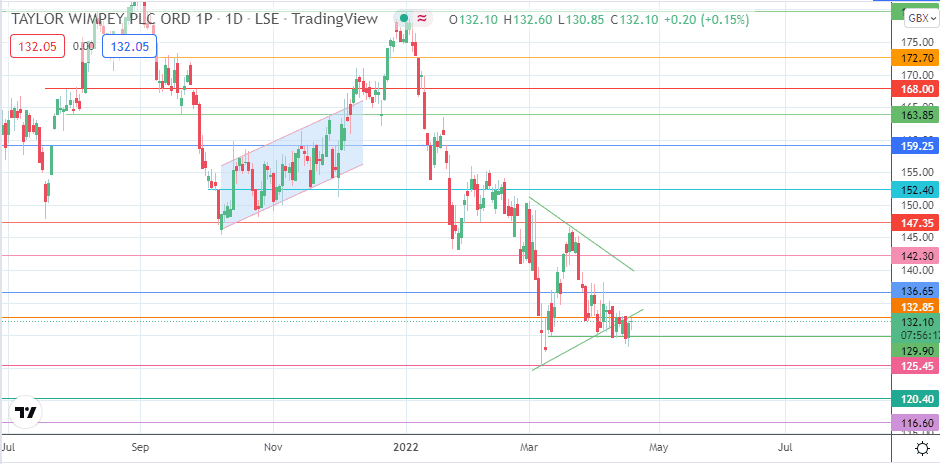

Following the symmetrical triangle breakdown last week, the stock was unable to break down the 129.90 support level (10/31 March lows). The bears resisted the accompanying bounce on 15 April at the 132.85 resistance. This barrier combines with the triangle’s lower border (now acting in role reversal as a resistance) to form a barrier to any recovery moves.

The bulls must force prices above this combined resistance for 136.65 to become a viable new target. This move would also invalidate the previous downward move from the triangle’s breakdown. Above this new level, 142.30 and 147.35 (18 March 2022 high) are additional barriers to the north.

On the flip side, sellers must seize the initiative from the rejection at 132.85 to take out the support at 129.90 before the measured move to the south can continue. This measured move targets completion at 116.60, leaving 125.45 (7 March 2022 low) and 120.40 as the pivots that must be degraded before this completion is attained.

Taylor Wimpey: Daily Chart

Follow Eno on Twitter.