Wall Street indices started higher the day with the S&P 500 adding 1.02% at 2,906.0. The Dow Jones trading 0.54% higher at 26,155, while the Nasdaq trading 0.99% higher at 7,941 as investors worries on trade war ease, after better trade data from China. S&P 500 gets a lift from AMD and Symantec with gains above 10%, on the other hand the index is dragged by Kraft Heinz which is down over 13%.

The interest rate cuts by central banks around the world continues as yesterday India, Thailand and New Zealand added to Australia, South Korea and the Philippines to rate cuts since May. The global reflation scenario is intact and easier credit conditions from most of the major central banks, including the Fed, are coming and will be the dominant fundamental that supports global equities in the long term.

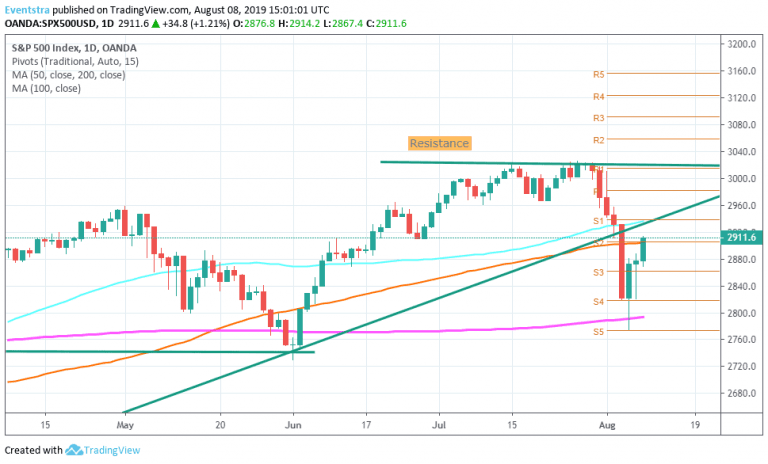

S&P 500 returned today above the 100 day moving average and the bulls are returning to the game for the short term while for the midterm is on a rising trend channel. On the upside immediate resistance is at 2,930 the high from August 5th and then at 3,000 round figure. On the downside S&P 500 first support stands at 2,867 today’s low and then at 2,793 the 200 day moving average. Traders looking to enter long positions can buy if the index closes above 2,904 the 100 day moving average , targeting the 3,000 level for profits, and can keep their long positions as far the index is trading above the 2,867 mark.

The European Indices trading higher. The FTSE 100 is 0.81 percent higher at 7,257.04 as the pound trades above 1.2126. DAX index is 1.24 percent higher to 11,799 while CAC 40 in Paris also trades 1.74 percent higher at 5,358.Don’t miss a beat! Follow us on Telegram and Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.

Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.