In the light of the Evergrande Group’s solvency challenges, the S&P 500 index has plunged this Monday following a global stock market selloff. The S&P 500 index is down by 1.59%, as the potential for the collapse of Chinese property developer Evergrande Group becomes more apparent by the day.

Credit Suisse is lending its voice to the recent price moves on the index and has warned that a push below the 63-day moving average at 4407 could lead to a setback that tests the August low at 4368 and potentially 4238/4233. With the price now violating the 4368 price mark under heavy bearish pressure, what is the outlook for the index this Monday?

S&P 500 Index Outlook

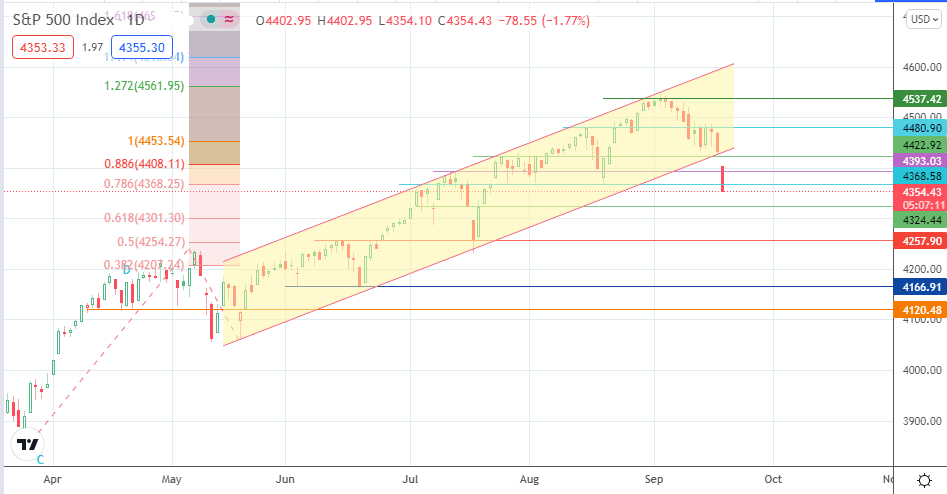

The bearish gap has broken below the 4393 support level and violated the 4368 price support (August 2021 low). If the price closes below this support with a 3% penetration, the breakdown is confirmed, opening the pathway towards 4324. Below this level, 4257 is an additional price target for bears.

On the other hand, bulls need a bounce that enables some bullish momentum that targets a break of 4480. This move restores the potential for a push towards 4537. A break of this level sends the S&P 500 to new highs, targeting 4561 and 4699 as new potential targets.

S&P 500 Index: Daily Chart

Follow Eno on Twitter.