Silver price crawled back on Monday morning as the overall market sentiment improved. XAG/USD is trading at $21.33, which is about 3.6% above the lowest level last week. The price action is in line with that of gold, which has risen to $1,837. Other metals like palladium, platinum, and copper have all bounced back in the past few days.

Why is Silver rebounding?

Silver is both an industrial and precious metal. As an industrial metal, it is widely used to manufacture important items like kitchenware and solar panels. Therefore, silver tends to do well in periods when the economy is performing well.

With the world moving towards a recession, silver has crashed by more than 20% from its highest point this year, meaning that it is in a bear market. Zooming back, silver has dropped by about 30% from its highest point last year.

Silver price has underperformed because of the rising risks to the global economy and the ongoing tightening by the Federal Reserve. The bank has already hiked interest rates by 150 points this year and signaled that higher hikes are on their way. In a statement last week, Jerome Powell warned that these hikes will likely continue in the coming months and that a recession was possible.

Silver has also lagged because of the slowdown in China, its biggest market. China has been struggling recently because of the Covid-19 pandemic. At the same time, silver mining companies have boosted their production.

Silver price prediction

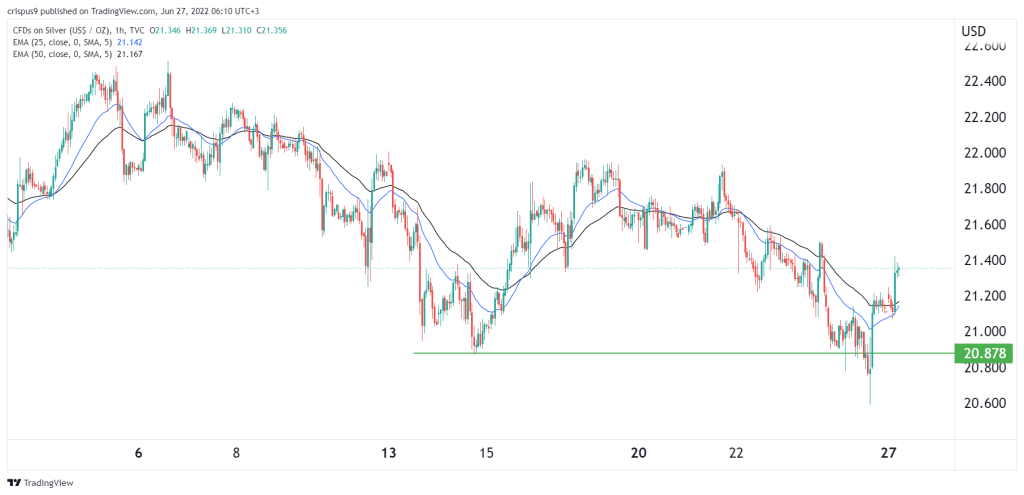

The hourly chart shows that silver formed a hammer pattern that is shown in green below. In most periods, a hammer is usually a bullish sign, which explains why the metal has risen in the past few days. The metal has moved above the important resistance point at $20.87, which was the lowest point on June 14th. The 25-period and 50-period moving averages have made a bullish crossover as well.

Therefore, there is a likelihood that silver will continue rising as bulls target the key resistance at $22, which is about 3.13% above the current level. On the flip side, a move below the support at $21.2 will invalidate this view.

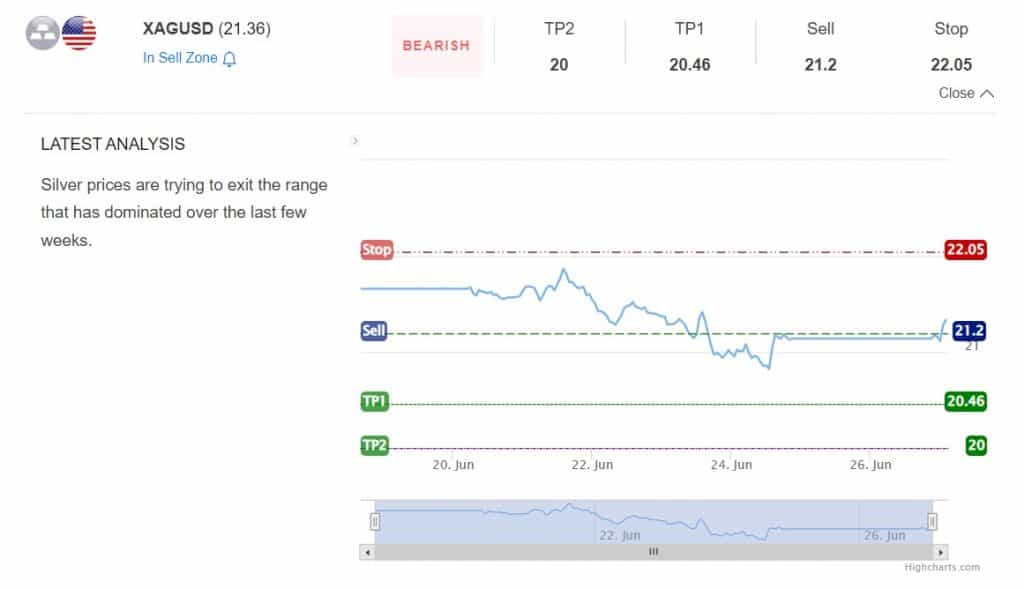

XAG/USD support and resistance levels

My bullish view contradicts that of our highly accurate S&R indicator which has a bearish outlook. The indicator expects that silver will drop to $20.46 and then move to $20, as shown below. Its stop-loss is at $22.