Silver price action is set to complete the third consecutive day of losses if the bears can maintain the 0.43% drop experienced so far in Tuesday’s trading session. Silver price saw the latest slide jumpstarted after Fed Chair Jerome Powell’s hawkish remarks at the Jackson-Hole Symposium on Friday, posting a 1.81% loss on that day. The two-day slide seen this week is a continuation of the bearish sentiment provoked by the remarks.

This week, a fundamental trigger for silver price action comes from the US ISM Manufacturing PMI data and the Non-Farm Payrolls on Friday. Last week’s PMI data from the Eurozone and the UK did very little to help the cause of silver prices, and the slump from the 15 August high of $20.87 also came as China reported a drop in its industrial production. Hawkish actions and Fedspeak are also helping to keep silver prices subdued. The situation could be exacerbated if long-term bond yields continue to rise in anticipation of aggressive action from the Federal Reserve.

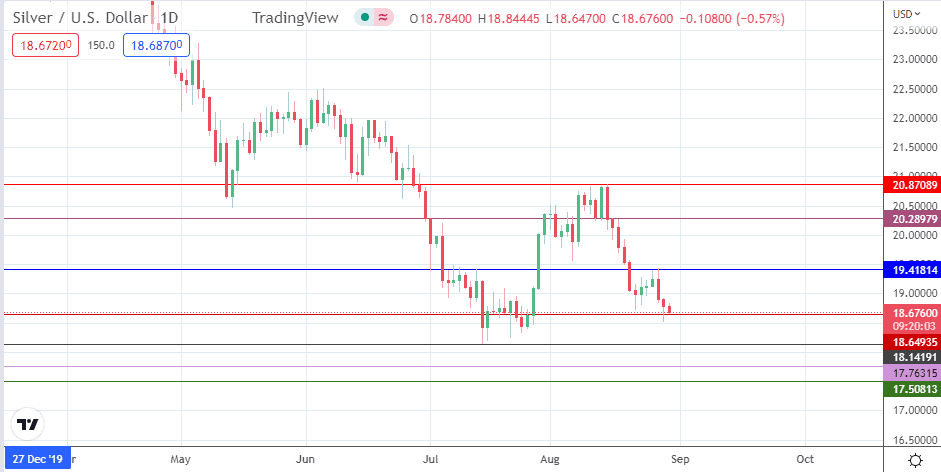

From a technical analysis perspective, the 18.64935 price mark remains the pivot to beat for the bears. The bulls rejected Monday’s downside violation of that level, and this level has so far held firm in Tuesday’s session. Therefore, the behaviour of traders at this level will determine the price action for the white metal, as indicated in the forecast below.

Silver Price Forecast

The 18.64953 support level, formed by a previous high of 25 February 2020 working in role reversal after it was broken on 10 July 2020, is the primary barrier to the bears. A breakdown of this area brings the 18.14191 support (14 July low) into the mix as the immediate target to the south. Further price deterioration sees 17.76315 (1 July 2020 low) become the next available target, followed by 17.50813 (11 June 2020/26 June 2020 low) if the march to the south gathers pace.

This outlook is negated if the bulls force a bounce on the 18.64935 support level, targeting 19.41814 initially (13 July and 26 August highs) before the psychological level at 20.000 (4 July 2022 high) becomes available as a new northbound target. The 1 July/17 August 2022 highs at 20.28979 and the 16 May low/17 August high at 20.87089 are the additional barriers to the north if the advance continues.

XAG/USD: Daily Chart