Filecoin hit new all-time lows in June, tipping Filecoin price predictions to the bearish end of the tape. The file-storing blockchain’s token tumbled 36% in June and followed an even steeper drop in April and May 2022. Filecoin held a lot of promise after raising an astounding amount of money in its 2017 Initial Coin Offering.

Indeed, it hit $252m in investments within thirty minutes of the sale. It listed on Kucoin at a $900 price, falling to as low as $10 on that day before closing at $62 as the pre-sale investors raked in profits. It only ever hit $237 on 1 April 2021 before the descent into the Antipodes began.

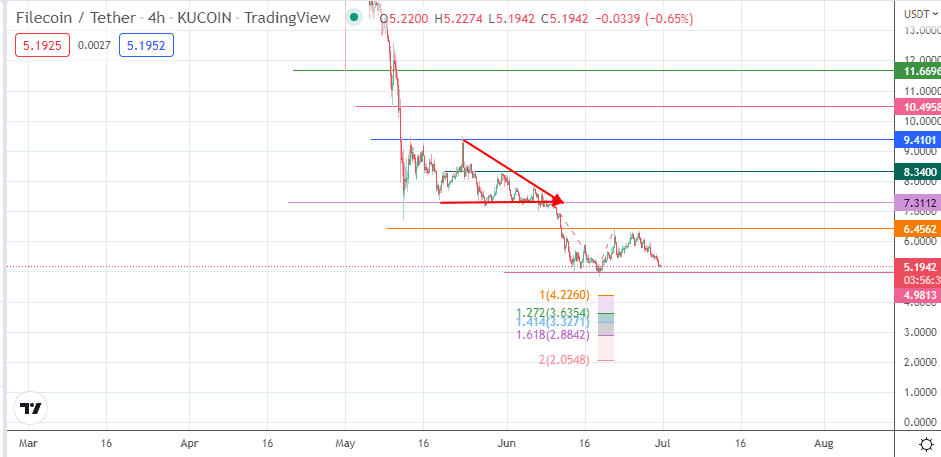

There are indications that if the bulls fail to defend the current support, FIL/USDT will hit new record lows. At $5.24, the current price of the FIL/USDT pair represents a 97.7% drop from the 1 April 2021 peak. The stock is currently targeting a retest of new lows seen in June 2022.

Presently, Filecoin’s price action is following the general market sentiment and not on any inherent fundamentals. The announcement of the Brave wallet’s integration with the Filecoin blockchain did not dent the negative sentiment. Such information will only have long-term potential when the market has recovered. The Filecoin price prediction depends on whether the bulls can save the support at 4.9813 or not. If they fail to do so, Filecoin could yet tumble to new lows.

Filecoin Price Prediction

The measured move from the descending triangle’s breakdown was completed at the 4.9818 support level. A retracement rally met resistance at 6.4562, and this has been followed by a downtrend continuation towards the 4.9813 support formed by the prior low of 18 June.

A decline below this level targets the 100% Fibonacci extension level at 4.2260. Additional targets to the south reside at the 3.6354 price mark (127.2% Fibonacci retracement level) and the 3.3271 price level, where the 141.4% Fibonacci extension level resides. These levels originate from a trace of price action from the 9 June swing high to the 18 June swing low and back to the 21 June price peak.

On the flip side, a bounce on 4.9813 retests the resistance at 6.4562. A clearance of this level puts the bulls on a collision course with the 7.3112 barrier (2 June low and 9 June high). Additional northbound targets reside at 8.3400 (31 May high) and 9.4101 (13 May and 23 May price peaks).

FIL/USDT: 4-hour Chart