Shell share price continued its recovery process as investors focused on the elevated crude oil and natural gas prices. The stock jumped to a high of 2,392p, which was the highest point since June 10 and about 22% above the lowest level in August. This performance mirrors that of other energy companies like BP, Chevron, and Marathon Oil.

Natural gas is a catalyst

Shell share price has done well as investors focus on the performance of the oil and gas market. Crude oil prices have remained stubbornly above the key resistance point at $90 and there is a likelihood that it will remain at an elevated level for a while. The OPEC+ cartel will meet next week and all signs are that the members will decide to slash production in a bid to boost prices. Shell benefits from rising demand and high prices.

The biggest catalyst for the Shell stock price is the performance of natural gas. Gas prices have surged in the past few months as Russia continues throttling its supplies to Europe. On Tuesday, Gazprom slashed its supplies to France’s Engie. It will also halt supplies to Europe for 72 hours and there are concerns that it could end its supplies.

Shell is a major beneficiary of this because of the amount of natural gas it sells. Besides, it is one of the biggest gas producers and sellers in the world. In a statement on Tuesday, Shell’s CEO warned that Europe should brace for more cold winters in the future. He said:

“It may well be that we have a number of winters where we have to somehow find solutions through efficiency savings, through rationing and as a very, very quick build out of alternatives.”

Therefore, Shell stock price will likely continue rising as investors price in strong growth and higher dividends, and more share buybacks in the coming months.

Shell share price forecast

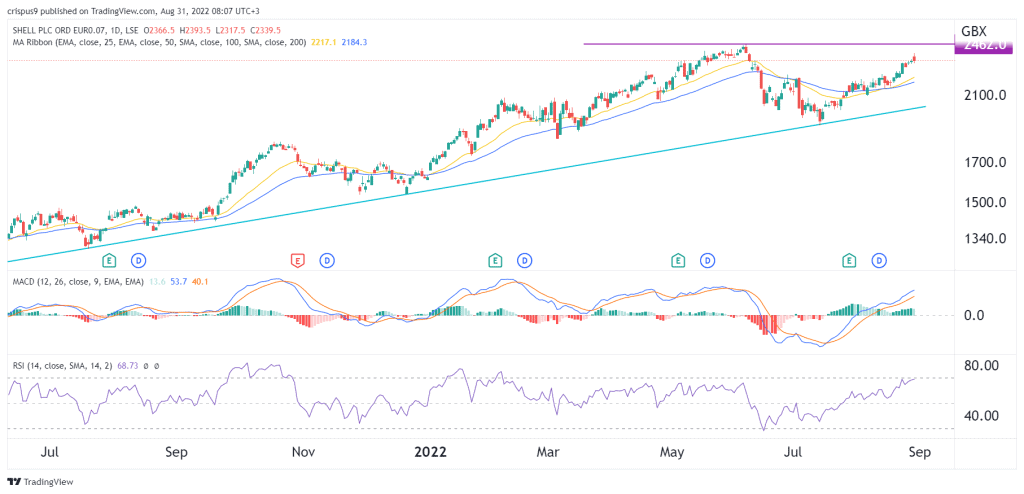

The daily chart shows that Shell shares have been in a strong bullish trend in the past few weeks. It remains above the ascending trendline shown in green. Also, the stock moved above the 25-day and 50-day moving averages. The MACD and the Relative Strength Index (RSI) have continued rising.

Therefore, Shell share price recovery faces one key hurdle at 2,462p. A move above this level will invalidate the double-top pattern that seems to be forming. If this happens, the next key level to watch will be at 3,000p.